CEF Lead Executives

-

JEFFREY SCHUBItem Link

SVP, Sustainable Finance Integration

Experienced executive in clean energy and climate finance, leading teams and complex initiatives to drive capital deployment across private, public and non-profit sectors. At Wells Fargo, lead enterprise-wide effort to meet the goal to deploy $500b of sustainable finance by 2030, along with other key initiatives meant to capture the commercial opportunity in sustainable finance while supporting clients’ transitions. Previously led the green bank movement as Executive Director of Coalition for Green Capital. Includes leading successful federal legislative campaign to create the EPA Greenhouse Gas Reduction Fund, a new $27B national green bank signed into law by President Biden as part of the Inflation Reduction Act. Over nearly a decade, our work drove the creation of over a dozen state and local green banks that catalyzed $15B of clean energy investment with a focus on underserved communities.

-

GENEVIÈVE PICHÉItem Link

Head of Sustainable Finance & Advisory

Geneviève oversees a team responsible for delivering thought leadership and a full suite of products aimed at helping clients achieve their sustainability objectives across Wells Fargo’s Commercial Real Estate, Banking, Markets, and International lines of business. She also leads Wells Fargo’s Corporate & Investment Banking (CIB) implementation of the company’s “net zero,” sustainable finance and climate risk integration goals. Previously, Geneviève was the head of Asset Management for Corporate & Investment Banking and before that, she was a managing director and relationship manager in the Corporate Banking group. Geneviève chaired Corporate Banking’s Diversity & Inclusion Council and served as a member of the Wholesale Banking’s D&I Council. Originally from Montréal, Canada, Geneviève earned her dual bachelor of arts degree in ecomics and international studies from Macalester College in St. Paul, Minnesota. She is an avid musician and outdoor enthusiast, and lives in Charlotte, North Carolina, with her husband and son.

-

READIE CALLAHANItem Link

Managing Director, ESG Solutions

Readie leads several strategic efforts such as operationalizing “net zero" and sustainable finance lending targets, implementing climate risk integration, and delivering solutions to help clients achieve their sustainability objectives. Most recently, Readie was the Head of Communications Strategy for the Wells Fargo LIBOR Transition Office. Readie joined Wells Fargo Securities in 2011 as an investment banker serving municipal and not-for-profit clients in the Government and Institutional Banking Group. Readie served as the Inclusive & Innovation Culture Chair for the Wholesale DE&I Council, Chair of the WFS San Francisco Women’s Network, a member of the WFS Women’s Network Executive Steering Committee and ran the WFS mentor program. Readie graduated from Washington University with a B.A. in French and International Area Studies. She was the recipient of the Young Alumni Award in 2017 for her service and support of the University and service to the Bay Area community. Readie is an avid triathlete and two-time iron(wo)man.

-

KELLY SOUZAItem Link

Managing Director, ESG Commercial Real Estate

Kelly is a managing director in the ESG Solutions Group within the Corporate and Investment Bank at Wells Fargo. She leads the Environmental, Social and Governance (ESG) efforts for Commercial Real Estate (CRE). In partnership with CRE leaders, she is tasked with developing and advancing a client-focused ESG strategy across environmental and social dimensions, as well as leading CRE’s sustainability and climate transition strategy. Outside of Wells Fargo, Kelly actively participates in numerous organizations, including the Bronze Multifamily Council of the Urban Land Institute (ULI) and the board of directors for Big Brothers Big Sisters of Puget Sound. Kelly enjoys fitness, travel, and outdoor activities with her partner and son.

-

ERIN LEONARDItem Link

Business Execution Director

Erin leads ESG disclosures for Wells Fargo. Previously, Erin managed Lockheed Martin's efforts around public disclosures, including the development of the annual Sustainability Report, GRI Index and SASB report. Erin was also responsible for ESG related stakeholder engagement activities, and supports other corporate enterprise risk and ESG activities. Prior to working for Lockheed Martin, Erin spent 14 years in the Consumer Products and Entertainment industries, with 3 years as the Global Sustainability Manager for Mattel, and 10 years at the Walt Disney Company in the Corporate Citizenship Environment and Conservation, Integrated Supply Chain Management, and Disney Consumer Products Corporate Citizenship departments. Erin holds a B.A. in Environmental and Legal Studies from Brandeis University, and a Master’s of Environmental Science and Management from the Donald Bren School of Environmental Science and Management at the University of California, Santa Barbara. She resides in Maryland with her husband, daughter, and 2 cats.

-

HARRISON THOMASItem Link

Climate Innovation Strategy

Harrison manages Climate Innovation Strategy at Wells Fargo. He collaborates across the bank’s businesses to develop ideas, partnerships, and opportunities to evolve the bank’s climate-related product/service offerings and customer experience. This role brings together his background in design thinking, business strategy, and sustainability. Prior to Wells Fargo, Harrison worked at SASB, McDonalds, and Deloitte. He has a MBA from UNC Chapel Hill and Masters in Environmental Management from Duke University. Harrison has two small children and spends most of his free time entertaining them with field trips and fun-sound-effects.

-

CURT RADKINItem Link

Sustainability Strategy

Curt leads Sustainability and Well-being Strategy for Wells Fargo Corporate Properties Group, responsible for developing strategies to further promote employee health and productivity while minimizing the environmental impact

of Wells Fargo’s operational footprint. Curt serves on Wells Fargo’s Innovation Incubator Internal Advisory Board, served as Board Chair for Envision Charlotte, is a +25 year volunteer for Habitat for Humanity and was recognized by Environmental & Energy News in 2020 as one of its top 100 leaders, innovators, shaker-uppers and doers for creating best practices to achieve greater success in environment and energy management. Prior to joining Wells Fargo, Curt practiced architecture for eleven years with a BS in Architecture from the Ohio State University.

Latest Sustainability Reporting

Sustainability and Governance Report, Climate Report

(Sept 2024)

CO2eMission July 2023 Supplement

(Sept 2024)

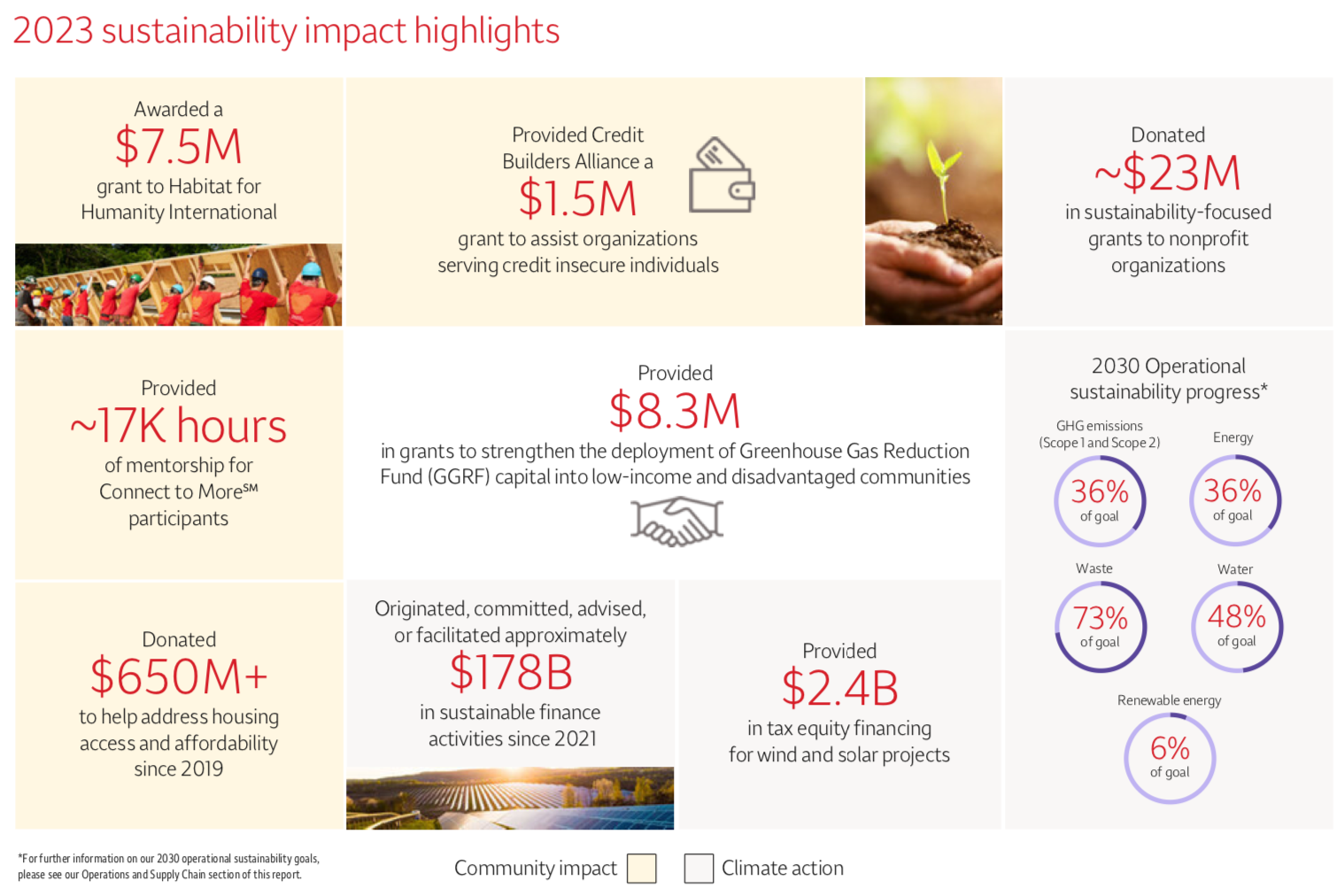

Highlights

- 25% reduction in aggregate GHG emissions for Scope 1 and Scope 2 (location-based) from 2019 baseline (2030 goal of achieving 75% reduction)

- 18% reduction in energy use from 2019 baseline (2030 goal to reduce by 50%)

- 36.5% reduction in total waste stream from 2019 baseline (2030 goal to reduce by 50%)

- 21.6% reduction in water usage from 2019 baseline (2030 goal to reduce by 45%)

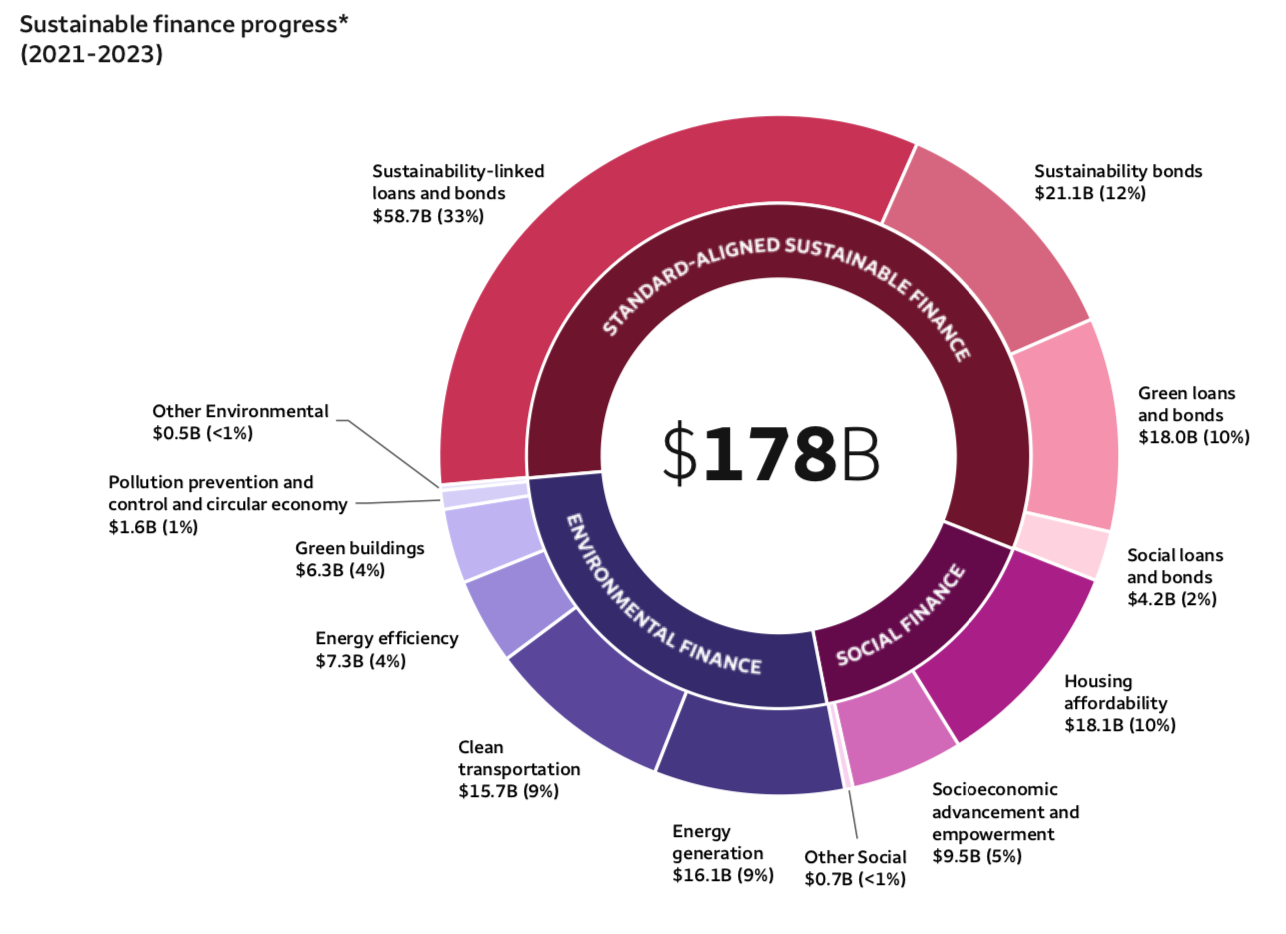

- $178 billion in sustainability finance activities since 2021

- $2.4 billion in tax equity financing for wind and solar projects in 2023, with a

total lifetime investment of $18.2 billion since launching its Renewable Energy & Environmental Finance program in 2006

Recent News

2023

Announced interim financed emissions targets for three new sectors: Automotive, Steel, and Aviation, aiming to reduce emissions intensity (from a 2019 baseline) for automotive by 53% (for new vehicle sales); aviation by 20% (CO2 per revenue ton kilometer); and work with steel clients to lower emissions beyond its current level of 1.01 tons of CO2/ton of steel, which is already lower than the IEA’s Net-Zero Emissions scenario baseline of 1.09 tCO2/t steel. (July 2023)

2022

Six of the largest U.S. banks will participate in a Federal Reserve pilot climate scenario analysis exercise in early 2023 to better understand and measure climate-related financial risks. The exercise is strictly for information-gathering purposes; it will have no capital or supervisory implications. The six participating banks include CEF members

Bank of America, JPMorgan Chase, Morgan Stanley,

and Wells Fargo, as well as Citigroup and Goldman Sachs. (Oct 2022)

MORE »

Announced two new 2030 targets for GHG emissions attributable to its financing activities: a 26% reduction in absolute emissions in the oil & gas sector, and a 60% reduction in portfolio emissions intensity in the power sector (2019 baseline for both). These targets are in alignment with the company’s net-zero-by-2050 goal and informed by the target-setting guidelines of the Net-Zero Banking Alliance (NZBA), which the company joined in 2021. (May 2022)

RMA Climate Risk Consortium — 19 banks—including CEF members Bank of America and Wells Fargo—formed a new consortium under the Risk Management Association (RMA) to develop “consistent taxonomy, frameworks, and standards” that help banks integrate climate-risk management into their operations. The consortium will also engage with regulators and policymakers to help inform climate-related policy considerations. (Jan 2022)

2021

The Taskforce for Nature-related Financial Disclosures (TNFD) appointed 30 senior executives

from financial institutions, corporations, and service providers

to the

TNFD Taskforce. Members will

form 5 Working Groups to drive the development of a

beta disclosure framework to be launched in early 2022. TNFD Taskforce members include executives from CEF members

Bank of America

and BlackRock.

TNFD also launched the

TNFD Forum, a consultative group with over 100 institutions to support the Taskforce that includes CEF Member

Wells Fargo Asset Management. (Oct 2021)

MORE »

The Wells Fargo Innovation Incubator (IN2) for cleantech and agtech startups is

partnering with the

Farmers Business Network

to give the IN2 agtech startups opportunities to test their technologies in real-world scenarios at scale.

(Sept 2021)

MORE »

Wells Fargo announced a new wave of support for entrepreneurs including an initiative focused on mentoring 500 women-owned businesses called Connect to More℠, and a second phase of funding from its Open for Business Fund aimed at providing 93 nonprofits the ability to expand access to experts that can help grow small businesses. (Aug 2021) MORE »

Climate Action 100+

— The group of 617 global investors managing over $55 trillion in assets

released a

set of expectations

laying out necessary actions for the food and beverage sector to achieve net-zero emissions in line with the Paris Agreement goals. Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments, J.P. Morgan Asset Management,

and

Wells Fargo Asset Management.

(Aug 2021)

MORE »

Launched a 10-year Banking Inclusion Initiative to help unbanked households—particularly Black and African Americans, Hispanics, and Native Americans—gain easier access to low-cost banking opportunities. It committed to redesigning 100 branches in low-to-middle income neighborhoods to enable one-on-one consultations, offer digital banking access, and conduct financial health seminars. (May 2021)

MORE »

Member companies of the Partnership for Renewable Energy Finance (PREF)—including Amazon, Bank of America, BlackRock, Google, JPMorgan, Morgan Stanley, and Wells Fargo—sent a letter to Texas officials opposing 3 energy-related bills, fearing they will upend the economics of wind and solar power in the state. (April 2021)

MORE »

Committed to achieving net-zero GHG emissions across its Scope 1, 2, and 3 by 2050. Interim goals include (March 2021):

- Disclosing its financed emissions measurement approach and providing more robust emissions data by 2022

- Setting interim emission reduction targets for select carbon-intensive portfolios—including oil and gas, and power—by 2022

- Establishing an Institute for Sustainable Finance to manage the deployment of an additional $500 billion to sustainable businesses and projects by 2030 and support science-based research and innovation in climate finance

- Integrating climate considerations into its Risk Management Framework

Announced

equity investments in six African-American owned banks. Wells Fargo will support each bank with a “single touchpoint coverage model” to

provide financial, technological, and product development expertise to help scale the institutions and create new benefits for the local communities. (February 2021)

MORE »

How can we help? Please reach out to us!

Laura Keenan, Chair

laura@corporateecoforum.com | (617) 921-2307

Amy O’Meara, Executive Director

amy@corporateecoforum.com | (857) 222-8270

Mike Rama, Deputy Director

mike@corporateecoforum.com | (607) 287-9236

Margaret Zamoyta, Program Lead

margaret@corporateecoforum.com I (917) 678-4161

MR Rangaswami, Founder