CEF Lead Executives

-

JULIE MULKERIN ORTIZItem Link

CEFNext

GM Decarbonization Strategy

Julie leads cross-functional teams in setting external and internal incentives for driving a lower carbon future, like GHG targets including net zero aspirations, carbon footprinting and accounting and other strategic initiatives. She has

been the lead author on four TCFD-aligned Climate Resilience Reports and in developing enterprise climate policy positions. Julie joined Chevron in 2008 after completing her MBA at USC and working in agricultural commodity trading and for the government. She earned her BA in Spanish at UC Davis.

-

RACHEL BONAFONTEItem Link

Manager, Global Issues and Public Policy

Rachel joined Chevron in 2014. In her current role, Rachel is responsible for advancing the company’s corporate responsibility practices and reporting, human rights and emerging issues management. Previously, Rachel headed the EU Affairs office for Chevron. Rachel began her career in government relations with internships in Washington DC, before working as a consultant (Brussels, Jakarta), and then in EU Affairs for Norsk Hydro (now Equinor). Before joining Chevron, she was Deputy Director with the International Association of Oil and Gas Producers (IOGP).

-

ROOPA KAMATHItem Link

CEFNext

Environmental Strategy Manager

Dr. Kamath is responsible for driving environmental performance across Chevron’s global operations. She has 20 years of experience in environmental risk management, assessment & remediation, as well as implementing circular waste management solutions across sites in the US, Latin America and Asia.

-

JENNIFER LIEBELER MICHAELItem Link List Item 1

Manager, Land & Biodiversity

Jennifer, an oceanographer and environmental scientist, has worked on energy, sustainability and environmental policy issues throughout her career in the academic, nonprofit, and business sectors. Currently, she manages the Research and Development Portfolio for Health, Environment and Safety for Chevron. Previously, she managed biodiversity issues for Chevron in the Gulf of Mexico. She led the development of land and water environmental performance standards for Chevron, designed to reduce the company’s environmental impacts on land and freshwater and optimize physical footprint of development projects worldwide. Prior to joining Chevron, Jennifer worked for environmental conservation and non-profit groups. She directed international marine programs for a coral reef conservation and education organization. At the Aquarium of the Pacific in Long Beach, she collaborated with exhibit designers and educators to develop exhibits and experiential learning programs on watershed, coastal zone, and ocean conservation issues.

Latest Sustainability Report

2023 Corporate Sustainability Report

(May 2024)

Highlights

- Decreased upstream methane intensity emissions 64% since 2016.

- Decreased nitrogen oxide emissions by 21% since 2019.

- Decreased volatile organic compounds emissions 44% since 2019.

- Planned capital allocation of $8B in lower carbon energy investments and $2B in carbon reduction projects from 2021 through 2028.

- Invested more than $1.2 billion in communities where they operate since 2016.

- Received a U.S. Fish and Wildlife Service Conservation Award for outstanding stewardship of natural resources and long-term dedication to endangered thistle recovery.

2023 Climate Change Resilience Report

(Oct 2023)

Highlights

- Details how Chevron is transitioning to a lower carbon energy future, providing updates on the company’s governance, risk management, strategy, portfolio, performance and policy, and metrics.

- Has $10 billion in planned capital allocation for lower carbon investments ($8 billion) and carbon reduction projects ($2 billion) by 2028.

- Between 2018 and 2022, has lowered its equity direct greenhouse gas emissions (Scope 1) by 19.7% and its portfolio carbon intensity by 3.3%.

- In 2022, more than 50% of equity direct emissions were in regions with existing or developing carbon-pricing policies. The company supports carbon pricing as a primary policy tool to achieve GHG emissions reduction goals.

- 60% of U.S. terminals are now capable of renewable or biodiesel distribution.

- Has trialed 14 advanced methane detection technologies since 2016.

Recent News

2024

PACT (Partnership for Carbon Transparency) — Launched its 2024 Implementation Program, with an expanded cohort of 25 companies, including CEF members BASF, Chevron, Procter & Gamble, Schneider Electric, and Unilever. The companies will work with their key suppliers to advance calculation and exchange of Product Carbon Footprint (PCF) data, improving transparency to stakeholders and enabling targeted decarbonization of their value chains. (July 2024)

The company’s venture capital arm launched its third Future Energy Fund, with a $500 million commitment, to invest in “novel low carbon fuels, advanced materials and transforming carbon to higher value products.” (April 2024)

2023

Announced it will expand its Bayou Bend carbon capture and sequestration (CCS) project along the Texas Gulf Coast to 140,000 acres (56,656 hectares), up from 40,000 acres, making this one of the largest CCS projects in the U.S. Bayou Bend, a joint venture between Chevron, Talos Energy, and Carbonvert, will hold a gross capacity of more than one billion metric tons. (March 2023)

2022

Incentives for Scope 3 supply chain decarbonization: accelerating implementation (WBCSD and PwC) — This new report pulls together insights on “decarbonization levers” presented in the past year, summarizing outcomes from WBCSD’s Incentivizing Supply Chain Decarbonization working group, which was set up to deepen the practical guidance shared and drive action on reducing Scope 3 emissions. Levers identified include: decarbonization criteria in procurement, beneficial terms, longer-term investments, mandatory carbon reporting, public recognition & co-branding, and engagement beyond tier 1 suppliers. CEF members in the working group include Unilever, Dow, Siemens, P&G, and Chevron. (Nov 2022)

INTERCONTINENTAL EXCHANGE, INC. (ICE) — Launched its first Nature-Based Solutions carbon credit futures contract (“NBS future”), “specifically designed to measure the carbon sequestration and storage capabilities of nature” according to Gordon Bennett, Managing Director of Utility Markets at ICE. Each NBS futures contract corresponds to 1,000 carbon credits, equivalent to the removal or reduction of 1,000 metric tons of greenhouse gas emissions. Projects represented by the credits preserve and maintain natural ecosystems and are Verified Carbon Unit (VCU) credits certified under Verra’s Verified Carbon Standard (VCS) Agriculture, Forestry and Other Land Use (AFOLU) Projects with Climate, Community and Biodiversity (CCB) Certification. Participants supporting the contract include Chevron Products Company, a division of Chevron U.S.A. Inc., EDF Trading, Elbow River Marketing Ltd. a fully owned Parkland Fuel subsidiary, the Macquarie Group, Shell, Trafigura, Vertree Partners and Vitol. (May 2022)

CHEVRON / TALOS / CARBONVERT — Announced an MOU for an expanded joint venture to develop the Bayou Bend CCS offshore carbon capture and sequestration (CCS) hub in Texas coastal waters. The Bayou Bend CCS lease, won by a joint venture between Talos and Carbonvert in 2021, is the first and only offshore lease in the U.S. dedicated to CO2 sequestration, with an estimated capacity of 225 to 275 million metric tons of CO2. Under the terms of the MOU, Chevron would support the project with a cash contribution and carry capital costs through the final investment decision (FID). In return, Chevron would take a 50% equity interest in the joint venture. Talos would remain the project’s operator. (May 2022)

EMERALD TECHNOLOGY VENTURES — Industrial tech venture capital firm Emerald Technology Ventures launched a new fund to invest in emerging sustainable packaging innovations and startups “across all stages of the circular economy ranging from raw materials to plastics recycling.” The fund aims to raise over $200 million and includes Beiersdorf, Henkel, and CEF members Chevron and WM as limited partners. (April 2022)

Aiming for Zero Methane Emissions Initiative — The CEOs of the 12 major oil and gas companies belonging to the Oil and Gas Climate Initiative (including CEF members Chevron and ExxonMobil) founded this new open, CEO-led initiative to eliminate methane emissions in the oil and gas industry. Signatories 1) support “sound regulations” to tackle methane emissions, 2) “will strive to reach near zero methane emissions from [their] operated oil and gas assets by 2030,” and 3) “will put in place all reasonable means to avoid methane venting and flaring, and … repair detected leaks.” (March 2022)

CHEVRON — Will stop operations in Myanmar, citing human rights violations and a deteriorating rule of law since the military coup last year. (Jan 2022)

2021

CHEVRON SHIPPING COMPANY — Joined the Sea Cargo Charter and committed to (Dec 2021):

- Annually calculating its GHG emission intensity and total GHG emissions and assessing the “climate alignment” of its chartering activities using the charter methodology

- Annually publishing the climate-alignment scores of its eligible chartering activities

- Ensuring that new chartering activities are compliant on a contractual basis

- Using data types, data sources, and service providers identified by the charter for climate alignment calculations

The SGE Methodology

(Chevron, Pavilion Energy, QatarEnergy)

—

A new methodology for calculating and reporting on GHG emissions associated with delivering liquefied natural gas (LNG) cargoes.

(Nov 2021)

MORE »

CHEVRON / EXXONMOBIL / JERA / OSAKA GAS / SHELL / TOKYO GAS —

The

partners of the

Gorgon liquefied natural gas project in Western Australia, which is operated by Chevron Australia, have

committed to buy carbon credits likely to cost over $180 million as a government penalty for failing to meet a five-year CCS target.

(Nov 2021)

MORE »

Committed to

investing approximately $29.3 million in "lower carbon projects" in Western Australia and

fulfilling its “regulatory obligations” to the

Gorgon liquefied natural gas project

(a joint venture that Chevron Australia operates)

“through the acquisition and surrender of 5.23 million greenhouse gas offsets.”

The investment is part of Chevron’s efforts to address a government penalty for the Gorgon project not meeting a five-year CCS target. (Nov 2021)

MORE »

MORE 2 »

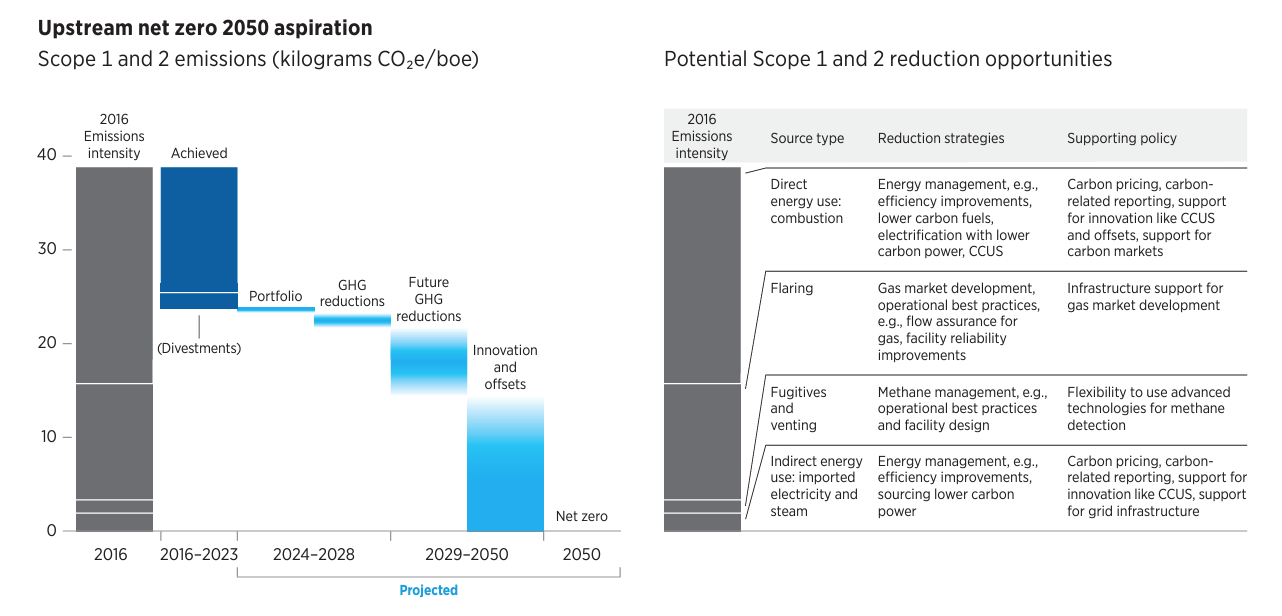

Unveiled a new

“aspiration” to achieve net-zero upstream Scope 1 and Scope 2 emissions by 2050. It also committed to

reducing its portfolio carbon intensity by at least 5% (Scopes 1-3), including the use of its products,

by 2028 (2016 baseline). (Oct 2021)

MORE »

“Call to Action for Shipping Decarbonization” —

Over

150 stakeholders across the global maritime value chain

sent a

call to action urging governments to commit to decarbonizing international shipping by 2050, deploying

commercially viable zero-emissions vessels by 2030, and delivering

policies that make net-zero shipping emissions “the default choice” by 2030. The 150 stakeholders (which include CEF member

Dow) were convened by the

Getting to Zero Coalition (which includes CEF members

Chevron Shipping, Honeywell,

and Unilever). (Sept 2021)

MORE »

Taskforce on Scaling Voluntary Carbon Markets (TSVCM) — The taskforce has formed an

independent Board of Directors to govern voluntary carbon markets, with

22 members

representing 12 countries (40% in the Global South); the NGO, academic, corporate, and financial sectors; Indigenous people; and local communities.

The Board will be supported by TSVCM’s founding sponsors, an Executive Secretariat, an Expert Panel, a Senior Advisory Council, and a

Member

consultation group of 250 organizations (including CEF members

Bank of America, BlackRock, BloombergNEF, Bloomberg Philanthropies, Boeing, Chevron, Delta, Google, JPMorgan Chase & Co., Microsoft, Morgan Stanley, Siemens,

and Unilever). (Sept 2021)

MORE »

MORE 2 »

Houston network for carbon capture and storage (CCS) —

11 petrochemical and energy companies—including CEF members

Chevron, Dow, ExxonMobil,

and

NRG Energy— agreed to“begin discussing plans” to develop a hub of CCS projects in Houston, Texas, which

Exxon proposed in April. The project is estimated to cost around $100 billion and, with "appropriate policies in place,"

could capture and store 50 million metric tons of CO2 annually by 2030 and 100 million per year by 2040.

(Sept 2021)

MORE »

Committed to investing over $10 billion by 2028 to reduce its carbon footprint—triple its previous investment—including $2 billion to reduce the carbon intensity of its operations. The company also set new 2030 targets (Sept 2021):

- Increase hydrogen production to 150,000 tons per year

- Increase renewable fuels production capacity to 100,000 barrels per day, including 40,000 MMBtu of natural gas production

- Increase carbon capture and offsets to 25 million tons per year by partnering with others to develop regional hubs

32 companies that have prioritized their workers during the COVID-19 pandemic

(e.g., by establishing safety practices, disclosing demographic details to drive racial equity, worker benefits)

have outperformed companies on the Russell 1000 by 8.6%, according to a JUST Capital

ranking of companies “leading for their workers” by industry. CEF members

BlackRock, Chevron, Comcast, Dow, Ford, JPMorgan Chase & Co., Lockheed Martin, McKesson,

and Procter & Gamble are among the 32 companies featured. (Sept 2021)

MORE »

CHEVRON / GEVO INC. —

Chevron and the renewable energy firm signed a letter of intent to

jointly invest in building and operating at least one facility for processing inedible corn to produce sustainable aviation fuel

(SAF). Chevron would have the right to offtake around 150 million gallons of SAF per year. (Sept 2021)

MORE »

CHEVRON / DELTA / GOOGLE —

Signed a memorandum of understanding to

measure sustainable aviation fuel (SAF) emissions and create a “more transparent model” for analyzing potential emissions reductions. The Chevron Products Company division will produce a test batch of SAF and sell it to Delta’s Los Angeles International Airport hub, with Google Cloud building an analytics framework to analyze the emissions data. (Sept 2021)

MORE »

Entered a new

joint venture with agricultural commodities trader Bunge North America wherein

Chevron will invest $600 million in two Bunge soybean-crushing facilities to nearly double their capacity in exchange for rights to use the soybean oil as renewables feedstock.

(Sept 2021)

MORE »

Created a "New Energies" division

to manage low-carbon investments and commercialization opportunities in hydrogen and carbon capture. (Aug 2021)

MORE »

Signed a memorandum of understanding with Cummins to explore the development of commercially viable opportunities in hydrogen and other alternative energy sources. (July 2021)

MORE »

The American Petroleum Institute—which includes

ExxonMobil and Chevron—released a new framework to standardize how companies log and report their GHG emissions, and to prompt them to make voluntary, public disclosures.

The 5-section template excludes Scope 3 emissions but includes logging data on GHGs emitted from company assets and from the energy companies use, as well as emissions-reduction efforts. Reporting is first expected in 2022. (June 2021)

MORE »

61% of Chevron shareholders supported a resolution requiring the company to reduce Scope 3 emissions from the use of its products, although a specific target was not specified.

Two additional proposals nearly passed: (1) 48% voted to require the company to disclose how its business would impact a 2050 global net-zero scenario, and (2) 48% voted for more in-depth disclosure of its lobbying activities. (May 2021)

MORE »

CHEVRON / TOYOTA — Signed an MOU to explore the development of "commercially viable, large-scale" hydrogen businesses in the United States. They plan to investigate the market potential for light-duty and heavy-duty fuel cell electric vehicles, collaborate on public policy developments to support hydrogen infrastructure, and explore research and development in hydrogen-powered transportation and storage. (April 2021)

Value Chain Carbon Transparency Pathfinder — New WBCSD-led initiative to define and accelerate the wide-scale exchange of verified primary carbon emissions data between businesses to increase scope 3 emissions transparency. Over a dozen companies are involved, including BASF, Chevron, Dow, Microsoft, and Unilever. Additional partners welcome. (March 2021)

Announced new emissions intensity cuts and plans to invest over $3 billion through 2028 to advance its energy transition strategy. The company will invest $750 million for investments in renewables and offsets and an additional $300 million (totaling $500 million) for its low-carbon fund. New 2028 emission reduction goals (benchmarked against 2016 levels) include: reducing CO2 emissions from oil production 40% by 2028; reducing CO2 intensity from gas production by 26%; reducing methane emissions by 53%. The company also plans to end routine methane flaring by 2030. (March 2021)

Chevron announced a partnership with Microsoft, Schlumberger, and Clean Energy Systems to build a carbon capture plant in California to convert agricultural biomass to electricity and store almost all the carbon captured in the conversion underground. The plant is expected to use about 200,000 tons of agricultural waste and remove roughly 300,000 tons of carbon dioxide annually. (March 2021)

Chevron launched a $300 million Future Energy Fund II to invest in low-carbon technologies that can provide “affordable, reliable, and ever-cleaner energy for all.” The first Future Energy Fund was launched in 2018 and invested in 10 companies with emerging solutions in carbon capture, emerging mobility, and energy storage. (March 2021)

Chevron announced a 6-year, “carbon-conscious deal” with Pavillion Energy to supply a half-million tons of liquefied natural gas (LNG) annually to Singapore beginning in 2023. Each LNG cargo delivered will be accompanied by a statement of its GHG emissions measured from wellhead to discharge port. (March 2021)

Startup geothermal energy company Evor Technologies completed a $40 million funding round—involving Chevron and BP—to advance the commercialization of its technology, which the company claims to be the world’s first truly scalable form of clean dispatchable power. Evor aims to power the equivalent of 10 million homes by 2030. (February 2021)

2020

Chevron subsidiary Chevron U.S.A Inc. announced a 4-year agreement with Algonquin Power & Utilities Corp. to co-develop 500 MW of renewable energy projects to help power Chevron’s global facilities. (August 2020)

Chevron committed $7 million to help communities and nonprofits address the COVID-19 pandemic. (April 2020)

2019

The Oil and Gas Climate Initiative — a CEO-led initiative supported by 13 oil and gas companies — presented a plan to double the amount of CO2 that is currently stored globally by 2030. Oil and Gas Climate Initiative members include BP, Chevron, ExxonMobil, Shell, and more. (Sep 2019)

How can we help? Please reach out to us!

Laura Keenan, Chair

laura@corporateecoforum.com | (617) 921-2307

Amy O’Meara, Executive Director

amy@corporateecoforum.com | (857) 222-8270

Mike Rama, Deputy Director

mike@corporateecoforum.com | (607) 287-9236

Margaret Zamoyta, Program Lead

margaret@corporateecoforum.com I (917) 678-4161

MR Rangaswami, Founder