CEF Lead Executives

-

AUDREY CHOIList Item 1

Chief Sustainability Officer & Chief Marketing Officer

Audrey Choi is Morgan Stanley’s Chief Sustainability Officer and Chief Marketing Officer, and a member of the Firm’s Management Committee. As Chief Marketing Officer, Audrey is responsible for stewarding the brand to reflect the firm's core values of leading with integrity and exceptional ideas across its businesses and geographies. As Chief Sustainability Officer, Audrey oversees the firm's efforts to promote global sustainability through the capital markets. In a career spanning the public, private and nonprofit sectors, Audrey has become a thought leader on how finance can be harnessed to address community concerns and global challenges. Prior to joining Morgan Stanley, Audrey held senior policy positions in the Clinton Administration, including serving as Chief of Staff of the Council of Economic Advisers, and Domestic Policy Advisor to the Vice President. Previously, Audrey was a foreign correspondent and bureau chief at The Wall Street Journal.

-

MELANIE NAGPAL

Executive Director

Engagement in Morgan Stanley’s Global Sustainability Office. She helps drive the firm’s sustainability reporting strategy, and partners with Morgan Stanley’s Investor Relations team to engage shareholders on sustainability topics. Prior to joining Morgan Stanley, Melanie was a Policy Analyst with the Principles for Responsible Investment (PRI). In this role, she worked with stock exchanges to accelerate the adoption of investor-focused sustainability disclosure across the capital markets, and partnered with investor signatories to engage global policy makers on sustainable finance topics. Melanie holds a B.A. with honors in Environment, Economics and Politics from Claremont McKenna College.

-

MATT SLOVIK

Managing Director and Head of Morgan Stanley’s Global Sustainable Finance

Matthew Slovik is a Managing Director and Head of Morgan Stanley’s Global Sustainable Finance group, where his focus is on mobilizing private-sector capital to address major global challenges. As the leader of the Morgan Stanley Investing with Impact Initiative, Matthew works across the firm to develop client-focused financial products and solutions that target strong financial returns as well as positive environmental or social impact. Under Matthew’s leadership, Morgan Stanley continues to develop innovative sustainable and impact investing solutions for institutions and individuals. Matthew has spent his entire career at Morgan Stanley, where he began working in the Firm’s Investment Banking Division. Most recently he worked in Morgan Stanley Alternative Investment Partners (AIP), the Firm’s institutional private equity fund investing business, where he helped lead the build out of the private equity impact investing program. During his career at Morgan Stanley, Matthew has also worked in the Firm’s Global Capital Markets, Wealth Management and Firm Management divisions.

-

MARISA DUKOVICH

Director, Global Sustainable Finance

Marisa is part of the Global Sustainable Finance group at Morgan Stanley. In her role she manages firm-wide sustainable operations strategy, supply chain ESG, and employee engagement around sustainability. Through these three main areas, Marisa’s work seeks to drive impact, improve efficiency and promote meaningful dialogue with employees on ESG topics. Since joining Morgan Stanley, she has been working toward the Firm’s 2022 dual goals of 100% renewable electricity and carbon neutrality. She has over 12 years’ experience in the sustainability field, working roles that span environmental policy and operations at the Natural Resources Defense Council and sustainability at the New York City Department of Education. Marisa holds a BS in Biology and Chemistry from Denison University and a MS in Sustainability Management from Columbia University.

Latest Sustainability Reporting

2023 ESG Report

(Sept 2024)

Highlights

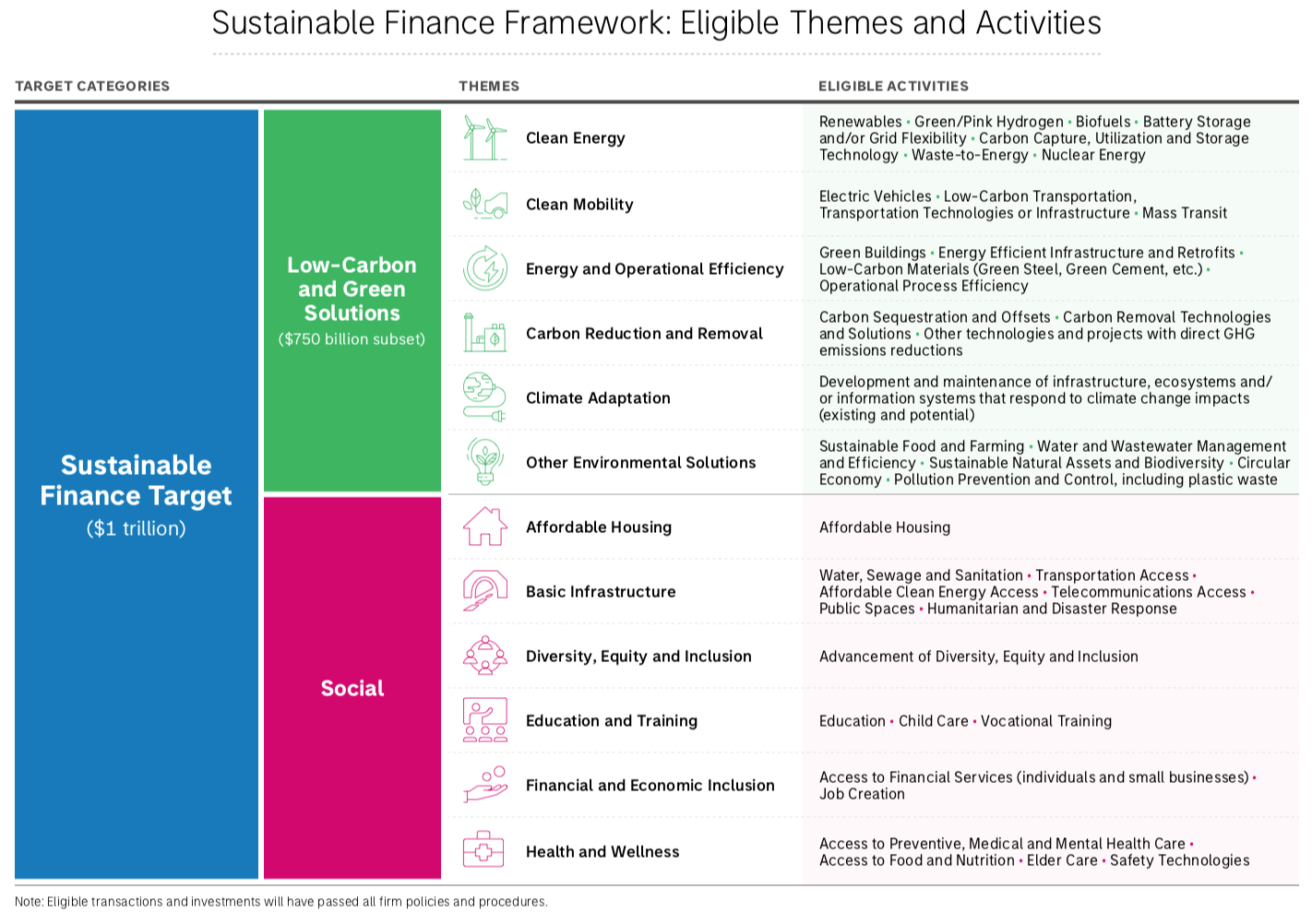

- Has mobilized over $820 billion for sustainable solutions since 2018, including over $640 billion in low-carbon and green solutions, and is on track to meet its 2030 target of $1 trillion.

- Supported over $97 billion in ESG-labeled debt transactions in 2023.

- Over $50 billion in assets under management include sustainability features.

- Made over $3 billion in Community Reinvestment Act qualified community development loans and investments in 2023.

- Maintained carbon neutral status and 100% renewable electricity throughout 2023.

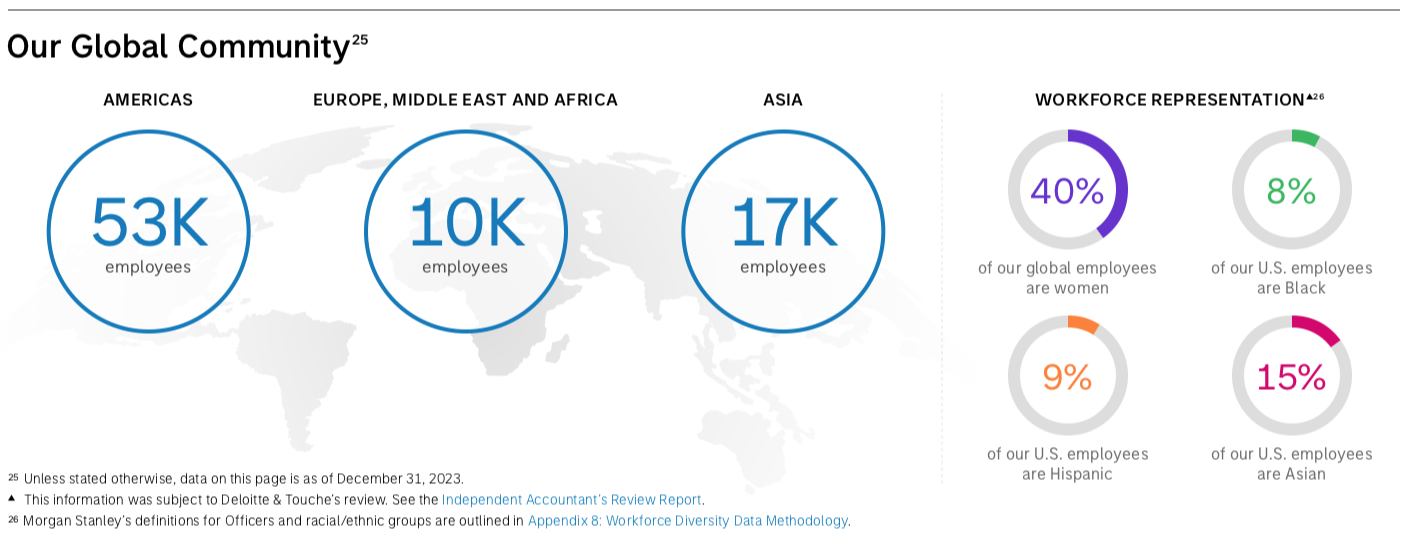

- Over 60,000 employees (nearly 75% of employees) gave 295,000 hours volunteering to local charitable organizations in 2023.

- 40% of global employees and 31% of board members were women in 2023.

- 8% of U.S. workforce were Black, 9% Hispanic, and 15% Asian in 2023.

Recent News

2024

78% asset managers and 80% of asset owners expect sustainable assets under management and asset allocations to rise in the next two years, according to a new survey of institutional investors from Morgan Stanley. This is driven by sustainable themes offering exposure to new growth opportunities; a more established track record for sustainable investing; and, for asset managers, increased client demand. (Dec 2024)

MORGAN STANLEY / CLIMEWORKS — Signed an agreement (lasting until 2037) to permanently remove 40,000 tons of CO2 from the atmosphere. This is Morgan Stanley’s first purchase of Direct Air Capture credits. (Oct 2024)

14 financial institutions expressed support for the call to action to triple nuclear energy capacity by 2050. These include CEF members Bank of America and Morgan Stanley. (Sept 2024)

Sustainable Aviation Buyers Alliance (SABA) —

Announced the largest ever collection of deals to purchase high-integrity sustainable aviation fuel certificates (SAFc). Fifteen companies (including

CEF Members JPMorgan Chase, Meta, Morgan Stanley, Netflix, and Samsung)

have committed nearly $200 million over five years to purchase SAFc (equal to about 50 million gallons of SAF). (April 2024)

2023

MORGAN STANLEY INFRASTRUCTURE PARTNERS (MSIP) — Created a joint venture with logistics, marine, and energy solutions firm Crowley to advance offshore wind energy initiatives for the U.S. The joint venture, Crowley Wind Services Holdings, will repurpose and operate existing U.S. port facilities and lease them to offshore wind developers under long-term contracts to support the manufacture, assembly, and storage of wind farm components. The terminals will also provide developers with maritime services, such as vessels to transport components from ports to offshore wind installations. (Sept 2023)

Has agreed to strengthen its deforestation policies for clients after Green Century Funds filed a shareholder proposal in the bank’s 2023 annual meeting. Morgan Stanley has agreed to enhance existing standards for palm oil and forestry clients and to create new written standards for soy and beef clients operating in regions with high deforestation risk. For timber clients in high conservation value forests, the bank will require best-practice Forest Stewardship Council certification or a time-bound plan to achieve it. (March 2023)

2022

Announced Morgan Stanley Investment Management has launched the 1GT growth-oriented private equity platform, which will focus on investing in companies in North America and Europe that will collectively avoid or remove one gigaton of CO2-equivalent emissions from the Earth’s atmosphere through 2050. Investments will focus on mobility, power, sustainable food and agriculture, and the circular economy. Half of the investment team’s incentive compensation will be tied to CO2 emissions avoidance/reduction. (Nov 2022)

Six of the largest U.S. banks will participate in a Federal Reserve pilot climate scenario analysis exercise in early 2023 to better understand and measure climate-related financial risks. The exercise is strictly for information-gathering purposes; it will have no capital or supervisory implications. The six participating banks include CEF members

Bank of America, JPMorgan Chase, Morgan Stanley,

and Wells Fargo, as well as Citigroup and Goldman Sachs. (Oct 2022)

MORE »

BLACKROCK / FORD / GOLDMAN SACHS / JPMORGAN CHASE / MORGAN STANLEY — Will disclose the race and gender of individual directors in deals reached with New York City (NYC) pension officials. The move is intended to demonstrate the companies’ alignment of hiring practices with their stated commitments on diversity and inclusion. Taking another view, NextEra Energy is urging its shareholders to vote against a resolution filed by the NYC pension funds for similar disclosures, noting by proxy statement that "The imposition of a prescriptive matrix by individual director can promote a check-the-box approach to refreshment, thus increasing the risk of bypassing a well-qualified candidate." The company already publishes details about the skills of individual directors, and infographics showing overall diversity statistics about the board. (May 2022)

theSKIMM — Mission-driven media company theSkimm created a public-facing database featuring voluntarily-shared leave policies of more than 480 companies, in an effort to increase transparency and provide accessible information from a wide range of employers to help empower workers and improve policies. The database builds on theSkimm’s viral #ShowUsYourLeave initiative (launched in 2021) and presents market research as well as specific company benefits and policies. Among the companies that shared their policies are CEF members Bank of America, Boeing, Cisco, General Motors, and Morgan Stanley. (April 2022)

Committed to investing $20 million over the next five years to launch the Morgan Stanley Institute for Inclusion’s (IFI) Equity in Education and Career Consortium, created to provide “awareness, access, and advancement” for over 30,000 low- to moderate-income high school and college students worldwide, particularly ethnically diverse students. Morgan Stanley will partner with the Morgan Stanley Foundation and a group of nonprofits to deliver consortium objectives. (Feb 2022)

2021

Reuters announced its 2021 Responsible Business Awards winners, recognizing companies that are truly having an impact on business, society and the environment, and delivering a new blueprint for business in the 21st Century. The following CEF members were classified as winners in the following categories (Oct 2021):

- Samsung earned the Circular Transition Award

- Trane Technologies earned the Business Transformation Award

- Morgan Stanley earned the Sustainability Trailblazer Award

- PepsiCo was highly commended for the Diversity, Equity & Inclusion Award

Set 2030 emission-reduction targets for three sectors in its lending portfolio—including corporate lending—to help reach its existing target of net-zero financed emissions by 2050 (Nov 2021):

- Reducing auto manufacturing emissions (Scopes 1-3) by 35%

- Reducing energy emissions (Scopes 1-3) by 29%

- Reducing power emissions (Scopes 1-3) by 58%

Taskforce on Scaling Voluntary Carbon Markets (TSVCM)

— The taskforce has formed an

independent Board of Directors to govern voluntary carbon markets, with

22 members

representing 12 countries (40% in the Global South); the NGO, academic, corporate, and financial sectors; Indigenous people; and local communities.

The Board will be supported by TSVCM’s founding sponsors, an Executive Secretariat, an Expert Panel, a Senior Advisory Council, and a

Member

consultation group of 250 organizations (including CEF members

Bank of America, BlackRock, BloombergNEF, Bloomberg Philanthropies, Boeing, Chevron, Delta, Google, JPMorgan Chase & Co., Microsoft, Morgan Stanley, Siemens,

and Unilever). (Sept 2021)

MORE »

MORE 2 »

Selected

8 startups for the 6th cohort of its

Multicultural Innovation Lab (MCIL), an accelerator program for tech and tech-enabled startups that supports diverse founders. The companies, working across the fintech, retail tech, health care, media, software, and marketplace sectors, will

receive MCIL investments and be presented to potential investors. (Aug 2021)

MORE »

RE100 — The RE100 companies, which are committed to 100% renewable electricity, now have an electricity demand greater than that of the U.K. or Italy and are on track to save CO2 emissions equal to burning over 118 million tons of coal per year. RE100 members include

CEF Members:

3M, Apple, Bank of America, Bloomberg, Dell Technologies, Ecolab, Facebook, General Motors, Google, Hewlett Packard Enterprise, HP Inc., Johnson & Johnson, JPMorgan Chase & Co., Mastercard, McKinsey & Co., Microsoft, Morgan Stanley, PepsiCo, Procter & Gamble, Siemens AG, TD Bank Group, Trane Technologies, Unilever,

and Visa.

(July 2021)

MORE »

Launched Morgan Stanley Next Level Fund, as part of Morgan Stanley Investment Management’s Private Credit & Equity platform, to invest in technology-enabled companies and early-stage technology with women or diverse founders,

with tech, financial tech, consumer/retail, health care, media, and entertainment as target sectors. Inaugural corporate partners include

Microsoft, Hearst, and Walmart.

(June 2021)

MORE »

Committed to mobilize $1 trillion towards sustainability solutions in support of the UN SDGs by 2030, including $750 billion to support low-carbon solutions—a three-fold increase from its initial 2018 pledge. (April 2021)

Member companies of the Partnership for Renewable Energy Finance (PREF)—including Amazon, Bank of America, BlackRock, Google, JPMorgan, Morgan Stanley, and Wells Fargo—sent a letter to Texas officials opposing 3 energy-related bills, fearing they will upend the economics of wind and solar power in the state. (April 2021)

Over 170 CEOs from U.S. companies issued a public letter to Congress backing President Biden’s $1.9 trillion coronavirus relief package and urged rapid, bipartisan adoption. CEF member companies involved included BlackRock, Comcast, Google, JetBlue, Mastercard, Morgan Stanley, Siemens, and Visa. (March 2021)

2020

Banks Help Nonprofits Tackle Coronavirus Relief and Social Inequity: In a move that could change philanthropy, foundations are asking investors to finance grant-making to nonprofits, which are essential to a post-pandemic recovery and more equitable future.

Morgan Stanley committed to reach net-zero financed emissions by 2050. (September 2020)

Morgan Stanley joined the Partnership for Carbon Accounting Financials and its Steering Committee, becoming the first major U.S.-based global financial institution to do so. As a result, the firm has committed to measure and disclose its approach to climate change risk and opportunity, including the GHG emissions of its loans and investments. (July 2020)

Morgan Stanley Institute for Sustainable Investing and Morgan Stanley Investment Managementissued results from a major survey, which found that a majority of asset owners globally are integrating ESG factors into their investment process. (June 2020)

Morgan Stanley committed $10 million in grants to support “critical frontline medical responders and community providers serving those economically impacted by the crisis.”The company has issued three grants of $2 million each to Feeding America, the CDC Foundation, and the World Health Organization’s COVID-19 Solidarity Health Fund. (March 2020)

The Morgan Stanley Institute for Sustainable Investing joined the World Economic Forum’s Global Plastic Action Partnership, a public-private collaboration platform that aims to “translate political and corporate commitment to address plastic pollution into tangible strategies and investible action plans.” (Feb 2020)

MORE »

Nine of the largest ESG mutual funds in the U.S. outperformed the S&P 500 Index last year, according to a Bloomberg report. The top performing ESG mutual fund in 2019 was the Ave Maria Growth Fund, followed by the Calvert Equity Fund and the Putnam Sustainable Leaders Fund. Morgan Stanley’s Global Opportunity Portfolio and the Brown Advisory Sustainable Growth Fund were top performers over a five-year period. (Feb 2020)

MORE »

Included on CDP “Climate Change A List,” which recognizes companies for demonstrating leadership on climate risk management in 2019. (Jan 2020)

2019

Published “Sustainable Signals: Individual Investor Interest Driven by Impact, Conviction and Choice,” which examines the attitudes, perceptions and behaviors of individual investors towards sustainable investing. (Nov 2019)

Morgan Stanley launched the Morgan Stanley Plastic Waste Resolution, which aims to catalyze, support, and help scale innovations and business-based solutions to tackle the global plastic waste challenge. The initiative is expected toprevent, reduce and remove 50 million metric tons of plastic wastefrom entering rivers, oceans, landscapes and landfillsby 2030. (April 2019)

Published (with Bloomberg) “Sustainable Signals: Growth and Opportunity in Asset Management,” which explores how asset management professionals are delivering sustainable investing solutions to clients and offers insight into where they see growth and opportunity. (Feb 2019)