CEF Lead Executives

-

ANNA CATRICALAItem Link

Senior Director, Enterprise ESG Strategy

Anna leads the Enterprise ESG strategy team at RBC Royal Bank where she is accountable for, implementing RBC’s ESG strategy in close partnership with the business; ESG performance management, as well as reporting. Her portfolio also includes human rights and financial wellbeing. Anna has been with RBC since 2016. When joining, she was part of the enterprise transformation team where she helped establish RBC’s initial climate strategy and operating model as well as RBC’s financial wellbeing strategy. This led her to her current role in the Enterprise ESG Strategy, Corporate Citizenship and ESG team. Previously, Anna has held roles in management consulting with Deloitte, and in assurance and tax services with Ernst & Young. Anna has a Bachelor in Business Administration and Masters in Business Administration from the Schulich School of Business, York University (Canada). Anna is also a credential holder of Canadian and American accounting designations, CPA, CA and CPA (IL).

-

DANA HUMMEL-SMITHItem Link

VP, Sustainable Finance

Dana is responsible for driving the integration of environmental, social and governance (ESG) factors into RBC Capital Markets’ Corporate Client and Global Markets advisory businesses. Dana joined RBC in 2017 in Corporate Banking in New York supporting lending transactions to Consumer & Retail clients and working closely with the Sustainable Finance Group to build out RBC’s capabilities in sustainability-linked loans. Previously, Dana has held roles in ESG consulting for asset management firms and in sell-side credit research at Bank of America Merrill Lynch and Goldman Sachs. Dana earned her Bachelor’s in Finance from Virginia Tech and is a Sustainability Accounting Standards Board (SASB) FSA Credential Holder.

-

EMMA ROGERSItem Link

Senior Director, Climate Strategy

Since joining RBC in 2017, Emma has worked on the climate strategy with a focus on evolving the bank’s ambition and integration with the bank’s business and functions. Emma now leads a team working on the climate strategy, governance and reporting. Emma has 14 years of experience in sustainability strategy, environmental management and policy development, and brings a unique combination of corporate and public sector perspectives to new challenges. Prior to joining RBC, Emma worked for Ontario’s Ministry of the Environment on the development and implementation of a climate change partnership strategy among other environmental policy files. She also worked at Tim Hortons and Sears Canada on sustainable procurement, sustainability reporting, marketing and environmental compliance. Emma received her M. Sc. in Environmental Management and Policy from the International Institute for Industrial Environmental Economics at Lund University, Sweden. She is a mother to two daughters, a painter and loves spending time in the outdoors.

-

MOSES CHOIItem Link List Item 1

Director, Sustainable Finance Group

As part of the Sustainable Finance Group within RBC Capital Markets, Moses collaborates with corporate and institutional clients to deliver innovative sustainable finance solutions. He joined the firm in 2021 with a focus on U.S. capital markets opportunities. Prior to joining RBC Capital Markets, Moses was Head of Digital and Sustainable Finance within the corporate venture team at Orange, the global telecommunications company, where he led sustainable and impact investing opportunities. Prior to Orange, Moses spent ten years in corporate and investment banking at Citigroup and Morgan Stanley. Moses holds degrees from Cornell University and the Fletcher School at Tufts University. Moses enjoys watching live music and hiking in the Bay Area where he is based.

-

CLIFFORD MANNItem Link

Sustainable Finance

Clifford is an analyst on RBC’s Sustainable Finance Group where he supports institutional clients as they navigate the transition to net-zero, providing bespoke ESG advisory services, sustainable debt origination and structuring, and thought leadership. Prior to joining RBC, Clifford worked in social enterprise consulting across sustainable real estate, financial inclusion, and affordable housing. He has also published academic research on the effect of a corporation’s voluntary disclosure on consumer patronage. Clifford holds a degree in Policy Analysis and Management from the Brooks School of Public Policy at Cornell University.

Latest Sustainability Reporting

Highlights

- Facilitated $29 billion in green finance in 2023.

- 100% of total global electricity sourced from renewable sources in 2023.

- Disclosed absolute financed emissions for oil & gas sector for the first time in 2023, which will guide its business strategy and emission reduction actions.

- Supported 150 partners in clean tech, agriculture, energy and nature-based climate solutions through $21+ million in community investments (up 72% since 2022).

- Launched the RBC Climate Action Institute to provide research to contribute to Canada’s climate progress.

- Published an updated Approach to Human Rights, describing how RBC will integrate human rights into operational policies and procedures.

- Women made up 43% of and Black, Indigenous and people of color made up 25% of new executive appointments in 2023.

Recent News

2024

MICROSOFT / ROYAL BANK OF CANADA — Agreed to purchase 10,000 tons of CO2 removal credits over 10 years from Deep Sky Labs, Canada’s first commercial direct air capture (DAC) facility. Deep Sky will use eight different DAC technologies with the aim of measuring and optimizing their performance year-round (accounting for the Canadian climate). The technologies will be powered by renewable energy and CO2 will be stored in permanent carbon storage. (Nov 2024)

PR » BLOOMBERG »

Announced a plan to retrofit its 1,200 Canadian branches, aiming to cut 10,000 metric tons of onsite carbon emissions from its operational footprint. In the first phase, RBC will invest $35 million over three years on energy-efficient low carbon heating and cooling systems. (July 2024)

New York City (NYC) reached agreements with JPMorgan Chase, Citi, and Royal Bank of Canada for the banks to regularly disclose their "Energy Supply Ratio" (financing ratio of low-carbon energy to fossil fuels) and their underlying methodology. The agreements come after successful shareholder engagements by the NYC Comptroller and three of NYC’s pension funds (who also have Energy Supply Ratio shareholder engagements with three more banks outstanding). (April 2024)

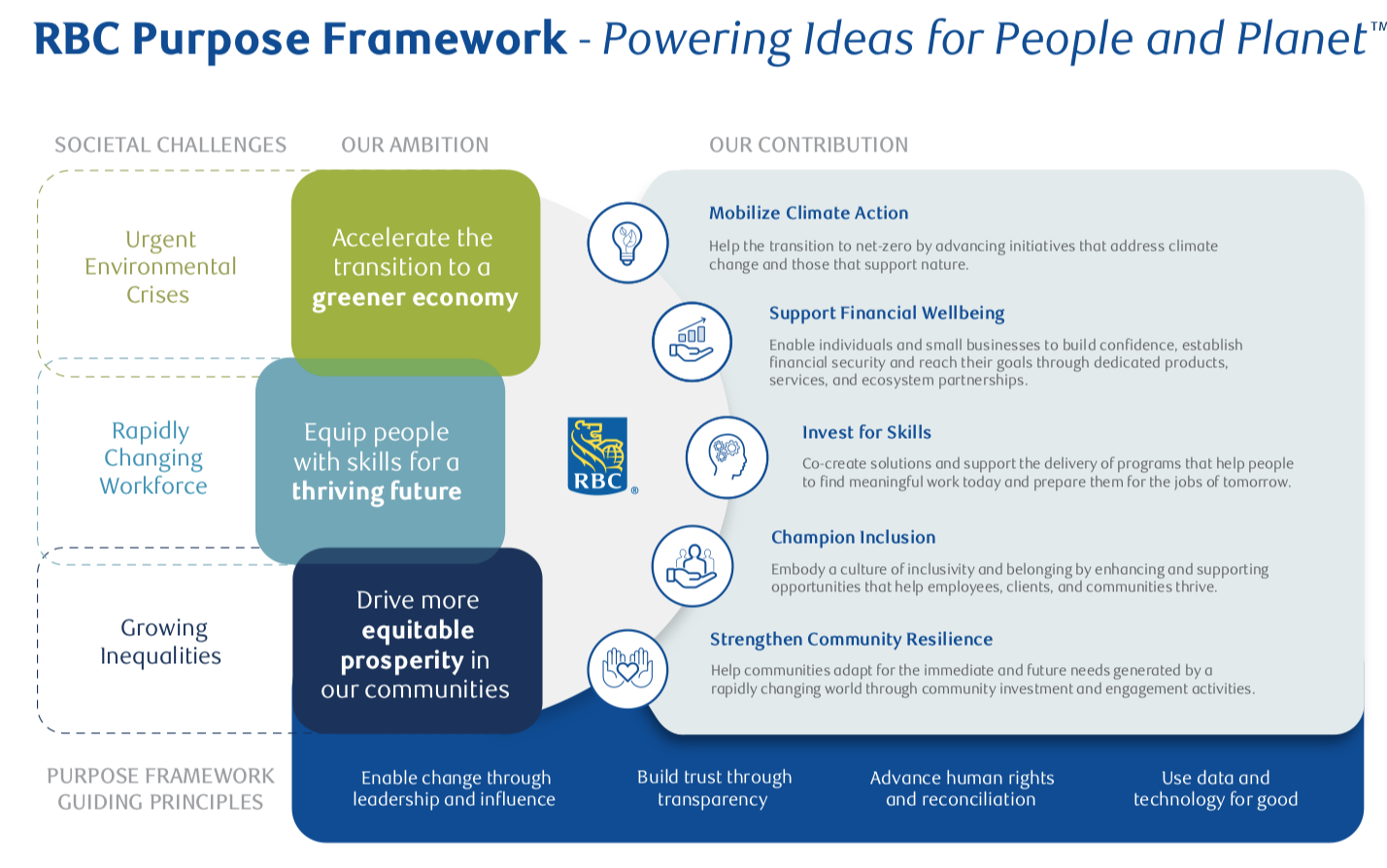

Announced three new actions it intends to take to accelerate the transition to a greener economy: 1) Triple lending for renewable energy across RBC Capital Markets and Commercial Banking and grow overall low-carbon energy lending to $35 billion by 2030; 2) Allocate $1 billion by 2030 to support the development of innovative climate solutions; 3 ) Accelerate capital deployment to emissions reduction efforts with a new decarbonization finance category. (March 2024)

2023

Joined the CEF member network in May 2023!

Launched the RBC Climate Action Institute to bring together research insights and industry experts to help clients and communities apply climate solutions across key sectors of Canada's economy. The institute will work closely with businesses and industry partners to design practical ways to reduce net emissions. It will focus initially on buildings & real estate, agriculture, and energy systems.

Announced that in 2023 it will add climate objectives to the CEO and group executives’ mid-term and long-term incentive plans. As RBC notes in its 2022 Climate Report, this will serve as “an additional incentive for the CEO and GE to accelerate RBC’s progress on these key priorities through innovation and engaging with governments, businesses and individuals to facilitate meaningful global progress towards net-zero over the short, medium and long term.” (March 2023)

2022

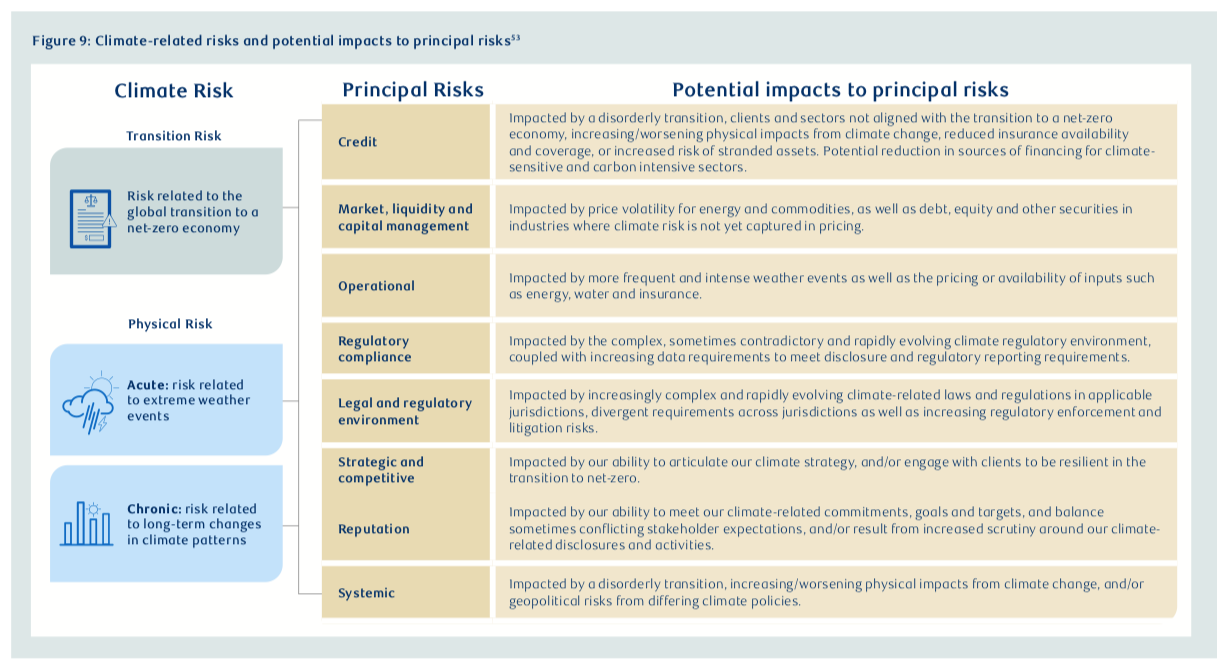

Royal Bank of Canada (RBC) set 2030 interim targets for three sectors: oil & gas, power generation, and automotive. For oil & gas, RBC aims for a 35% reduction in Scope 1 and 2 emissions intensity and an 11-27% reduction in Scope 3 emissions depending on government policies over that period. For power generation, RBC will aim for a 54% reduction in Scope 1 emissions. For automotive, the bank is aiming for a 47% reduction in Scope 1, 2, and 3 emissions. RBC is also aiming to provide $500 billion in sustainable finance by 2025. (Oct 2022)

2021

RBC committed to net-zero emissions in its lending portfolio by 2050 and announced an increased commitment to mobilize $500 billion in sustainable finance by 2025, after successfully fulfilling its first $100 billion in 2020. It also plans to achieve net-zero emissions in global operations by 2025 by reducing GHG emissions by 70% and sourcing 100% of its electricity from non-carbon emitting sources. (March 2021)

How can we help? Please reach out to us!

Laura Keenan, Chair

laura@corporateecoforum.com | (617) 921-2307

Amy O’Meara, Executive Director

amy@corporateecoforum.com | (857) 222-8270

Mike Rama, Deputy Director

mike@corporateecoforum.com | (607) 287-9236

Margaret Zamoyta, Program Lead

margaret@corporateecoforum.com I (917) 678-4161

MR Rangaswami, Founder