CEF Lead Executives

-

AMBER TOFILONItem Link

Head of U.S. ESG

Amber leads TD’s ESG program in the US. Amber’s team brings essential US insight and perspective to TD’s enterprise ESG initiatives, including on the evolving US landscape. Prior to her current role, Amber practiced law as a bank regulatory lawyer for TD. When not working, Amber enjoys hiking, cycling, and yoga. She lives in Maryland with her husband, two children, and two cats.

-

EDINA CAVALLIItem Link

VP, Strategic Sourcing Group

Edina is responsible for Vendor Management Centre of Excellence, Strategy, Operations and ESG. Prior to her current role, Edina was a VP at TD's Treasury and Balance Sheet Management Function and lead TD's Benchmark Rate Reform and Negative Rates Initiatives. Previously she was a Managing Director at RBC’s Legal Department heading up the US Bank Regulatory practice. She also served as Enterprise Dodd-Frank and G20 Regulatory Reform Liaison for TD’s Corporate Office in Toronto and was the Business Lead for the Enterprise-wide implementation of Volcker Rule requirements. Edina also worked at Barclays where she was Global Head of PE & PI and Risk as well was Americas Head of Funds & Advisory and IBD FIG Advisory Compliance in New York and served as CCO of an SEC registered investment adviser. Edina is an English qualified solicitor and holds both a common law and a civil law degree.

-

SHELLEY SYLVAItem Link

Head of Social Impact

Shelley Sylva leads TD Bank's Ready Commitment and its Charitable Foundation, responsible for leading, developing and executing on the bank's Corporate and Social Responsibility strategy. She is the lead champion for efforts across the US bank to align CSR strategy to business objectives providing a financial return to the bank, enhancing the brand and reputation, elevating the employee value proposition while creating social and environmental impact. She previously served as TD Bank’s Director, External Counsel and Knowledge Management, VP/Senior Manager, External Counsel and Knowledge Management and VP/Senior Manager Legal Operations and Governance. Prior to TD Bank, Sylva was Managing Principal at Henper Consulting and Assistant Executive Director at the Philadelphia Housing Authority. Sylva holds a JD from Temple University and a Bachelor’s degree from University of Virginia.

-

REBECCA FRISCHItem Link

Head of Planning and Community Engagement

Rebecca manages Commercial Bank ESG and sustainability initiatives, operations, communications, executive deliverables, and regulatory relations, among other areas, and works closely on Commercial Bank strategy development and execution. Before joining TD Bank in 2013, Rebecca spent several years in Washington D.C., first as a Presidential Management Fellow at the U.S. Department of the Treasury, and later as an associate at Promontory Financial Group. While at Treasury, Rebecca served on the initial team to stabilize the U.S financial system during the height of the 2008 financial crisis. Immediately prior to joining TD Bank, Rebecca served as a senior advisor to former Boston Mayor Thomas M. Menino. Rebecca is a former board member of MassEcon, the State of Massachusetts’ non-profit partner in promoting business development. Rebecca also started a mentoring program for TD Bank and Codman Academy Charter School in Boston, where she served as a mentor to high school students. Rebecca earned a Master of Public Policy degree from The University of Chicago and a Bachelor of Arts degree cum laude from Brandeis University.

-

NICOLE VADORIItem Link List Item 1

AVP and Head of Environment

Nicole leads a team of subject matter experts to provide innovative solutions to today's business and environment challenges. Nicole oversees a diverse portfolio which includes initiatives geared at greening the Bank and its products and services, proactively managing environmental risk within banking activities, advancing sustainable finance and investing, enhancing community green spaces through TD Friends of the Environment Foundation, and engaging with communities, colleagues, and customers on environment. Nicole has been instrumental in delivering key initiatives to strengthen TD's leading position in the environmental sector, including the issuance of the largest green bond by a Canadian bank at US$1 billion, the first commitment by a Canadian bank in support of the low carbon economy at CA$100 billion, the first green bond investment statement published among North American banks, and TD's 100% Renewable Energy Commitment.

-

CHRISTINE RHODESItem Link

AVP, ESG Reporting and Measurement

Prior to joining TD Bank, Christine Rhodes was a Manager in EY’s Climate Change and Sustainability Services practice. With a background in finance and risk management, Christine’s work included environmental and social impact valuation; sustainability impact management programs; sustainability strategy and governance; ESG reporting and disclosure; and, stakeholder engagement. Christine received a Bachelor of Commerce (Finance) from McGill University and holds a certificate in Risk Management from the University of Toronto. She has been trained in the use of the AccountAbility’s AA1000 international Stakeholder Engagement Standard and Assurance Standard and the performance and analysis of Life Cycle Assessments in partnership with Quantis and CIRAIG.

-

NOAH BRITOItem Link

AVP, Decarbonization Strategy

Working with key business and risk partners within the bank, Noah leads the development of TD Scope 3 Financed Emissions targets and the continual evolution of sector-based transition strategies, enabling greenhouse gas reduction and adoption of clean techlogy. Over the past year, Noah has led the complex mandate of developing targets to align TD's financing portfolios to the global climate change goal of net zero emissions by 2050, delivering TD's first set of targets covering the Energy and Power sectors in 2022 and Automotive and Aviation in 2023. He established the new specialized group focused on decarbonization strategy tasked with calculating financed emissions for the bank, setting and managing interim emissions targets, and supporting businesses to deliver on TD's Climate Action Plan. Prior to joining TD, he obtained his MBA from Ivey Business School and worked as a Senior Engineer for SLB.

-

ANASTASTIA OSTAPCHUKItem Link

Winner CEF Leadership Program (2018)

Senior Manager, ESG Policy & Commitments

Anastasia has been with TD Bank Group since 2014. Prior to her current role, she was a manager on the Corporate Environmental Affairs team at TD Bank Group and has held several roles contributing to the execution of TD’s Environmental and Corporate Citizenship Strategy, including managing the environmental reporting program, executing on TD’s carbon neutral commitment, and developing TD’s Green Bond Framework. Her most recent role is focused on managing environmental and social risks and opportunities. Prior to joining TD, Anastasia worked with a sustainability consultancy and the Canadian local network of the UN Global Compact.

-

JASON D. EVANSItem Link

Manager of Responsible Sourcing & Supplier Diversity

Jason recently joined TD Bank. Previously, Jason was the Supplier Diversity Specialist for Penn Procurement at the University of Pennsylvania, where his role was focused on Diversity and Economic Inclusion. For over 20 years, Jason has been an active community volunteer and leader with various organizations in Philadelphia, culminating with receiving the region’s prestigious 2022 Community Heroes Award. His humanitarian work includes serving as a board member of Philly AIDS Thrift as well as Philadelphia's LGBTQ+ Chamber of Commerce. He is also the former Co-Chair and inaugural member of the Mayor’s Commission on LGBT Affairs. Jason is a graduate of the University of Pennsylvania with Bachelor of Arts degrees in Sociology and Political Science, complimented by a Certificate in Law from Penn Law School. He is currently enrolled in the Fels School of Government at the University of Pennsylvania where he is working toward his Master’s Degree in Public Administration.

Latest Sustainability Reporting

(March 2025)

Highlights

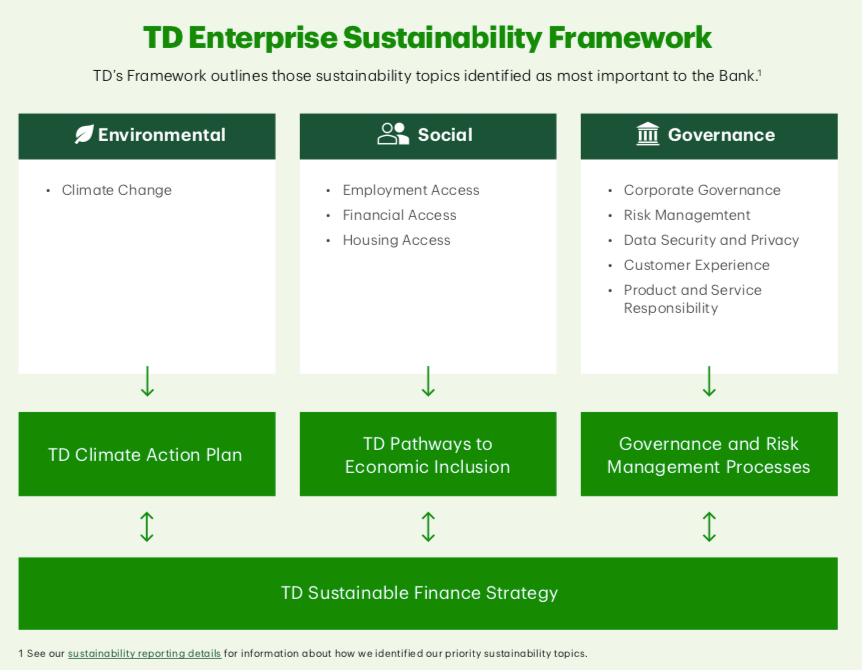

- Reduced Scope 1 and 2 GHG emissions by 29% in 2024 (2019 baseline).

- Reduced financed emission lending intensity in the energy sector 16% in 2024,and physical emissions intensity in the power generation, automotive manufacturing and aviation sectors by 10%, 2%, and 2% respectively (2022 baselines).

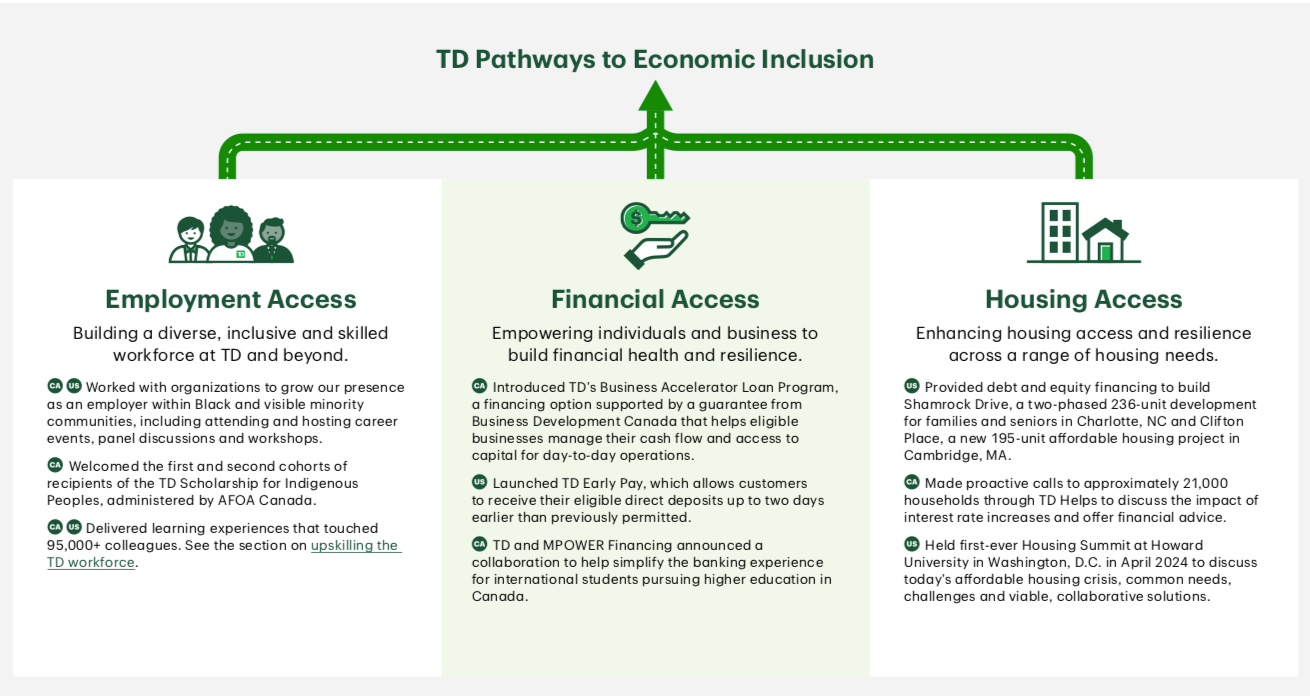

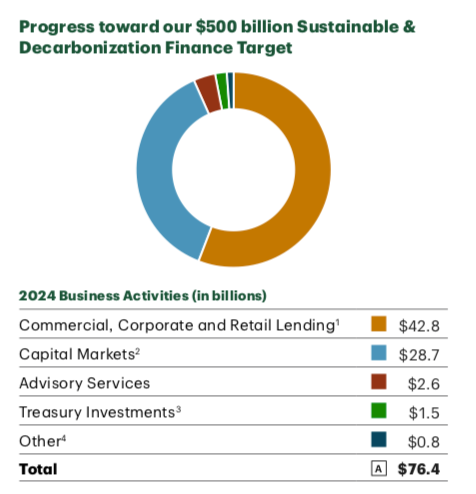

- Increased support to environmental, decarbonization and social activities to $145.9 billion through lending, financing, investing and other services in 2024, up from $69.5 billion in 2023.

- Invested $854 million in community giving, cumulatively since 2019, up from $685 million in 2023.

- Achieved its goal of reaching 500,000 participants through TD-led and supported financial education initiatives in Canada and the U.S. in 2024.

- Provided $5.9 billion in affordable housing financing in Canada and the U.S. (cumulatively since 2023).

- Increased the number of women in roles titled Vice President or above to 42.7% in 2024 from 41.6% in 2023.

- Increased the number of Black, Indigenous, and minority representation in roles titled Vice President or above to 25.7% in 2024, up from 24.3% in 2023.

Recent News

2023

Announced new ESG and sustainable finance measures. This includes a new CAD$500 billion ($363.5 billion) Sustainable & Decarbonization Finance Target by 2030, and new Scope 3 financed emissions 2030 targets for two additional sectors: aviation (8% intensity reduction) and automotive manufacturing (a 50% “tank to wheel” intensity reduction), from a 2019 baseline. (March 2023)

2022

RUBICON CARBON — Launched as a new carbon credit platform to scale and provide easier access to high-integrity emissions reduction solutions by vetting projects and their credits. Rubicon received an initial capital commitment of $300 million from CEF member TPG, with a total capital commitment target of $1 billion. As part of its launch, Rubicon also formed a coalition of corporate sustainability leaders to help guide its platform and product development, including CEF members Bank of America, Dow, GE, Honeywell, J.P. Morgan, JetBlue, McKinsey & Co., and TD Bank. (Dec 2022)

Set new Paris-aligned targets for its financed emissions in the Energy sector and Power Generation sector. By 2030, the company is targeting a 29% reduction over a 2019 baseline in financed emissions for the Energy sector (including clients involved in thermal coal mining, low-carbon fuels and technologies, and the exploration, transportation, and refining of oil and gas) and a 58% reduction over 2019 in financed emissions for the Power Generation sector (including clients involved in the generation of power). Targets cover clients’ operational emissions (Scopes 1 and 2) and end-use Scope 3 emissions (i.e., emissions that result from the end-use combustion of fossil fuels). (March 2022)

2021

Climate Action 100+

—

The group of

615 investors managing $60 trillion in assets released a new

report through IIGCC detailing their expectations for electric utility companies’ net-zero transitions. They called on utilities to target

net-zero emissions by 2035 in developed countries and by 2040 in developing countries, as well as a minimum 50% emission reduction by 2030. They also expect companies to

commit to providing a “just” net-zero transition.

Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments, J.P. Morgan Asset Management

(JPMorgan Chase & Co.’s asset management division), and

TD Asset Management

(of TD Bank Group).

(Oct 2021)

MORE »

TPG —

Announced a

first close of $5.4 billion for the TPG Rise Climate Fund, the largest climate-focused fund in the world. Over

20 global companies—including CEF members

3M, ADM,

Alphabet, Apple,

Bank of America, Boeing, Dow, GE, General Motors, Honeywell,

and

TD Bank Group—participated in the close and will form a

Rise Climate Coalition. The fund will take a broad sector approach, focusing on growth equity to value-added infrastructure to

driving solutions for 5 climate sub-sectors. (Aug 2021)

MORE »

RE100 — The RE100 companies, which are committed to 100% renewable electricity, now have an electricity demand greater than that of the U.K. or Italy and are on track to save CO2 emissions equal to burning over 118 million tons of coal per year. RE100 members include

CEF Members:

3M, Apple, Bank of America, Bloomberg, Dell Technologies, Ecolab, Facebook, General Motors, Google, Hewlett Packard Enterprise, HP Inc., Johnson & Johnson, JPMorgan Chase & Co., Mastercard, McKinsey & Co., Microsoft, Morgan Stanley, PepsiCo, Procter & Gamble, Siemens AG, TD Bank Group, Trane Technologies, Unilever,

and Visa.

(July 2021)

MORE »

2020

TD Bank Group issued a $500 million sustainability bond to “finance and/or refinance loans, investments and internal or external projects” that are considered to be environmentally or socially responsible under the bank’s Sustainable Bonds Framework. This is the Bank’s first-ever sustainability bond issuance. (October 2020)

TD Bank committed CDN$1 million to help front-line community health centers meet local needs, in collaboration with the Canadian Association of Community Health Centers and the U.S.-based National Association of Community Health Centers. (April 2020)

How can we help? Please reach out to us!

Laura Keenan, Chair

laura@corporateecoforum.com | (617) 921-2307

Amy O’Meara, Executive Director

amy@corporateecoforum.com | (857) 222-8270

Mike Rama, Deputy Director

mike@corporateecoforum.com | (607) 287-9236

Margaret Zamoyta, Program Lead

margaret@corporateecoforum.com I (917) 678-4161

MR Rangaswami, Founder