CEF Lead Executives

-

CHARLES CARBERRYItem Link List Item 2

VP Sustainability/Outdoor Experience

Charles has over 26 years of experience in the Environmental Services and Landscape Architecture industry. He is a practicing Landscape Architect and has the ability to apply proper business planning with practical, innovative, attractive design ideas. Prior to joining Fidelity, Charles was president of Ecotope Environmental Services (65 Employees) from 2008-2012. As leader of the firm, he developed strategies for growth in the environmental and sustainable services industry. Chuck was also a design manager of the first LEED-certified building in the state of Rhode Island.

-

PETER MILLSItem Link

VP, Sustainability

Peter directs sustainability efforts at Fidelity Real Estate Corporation (FREC), the business unit of FMR that manages Fidelity Investments’ global portfolio of real estate assets including corporate campuses, data centers and retail investor centers. Peter brings over 20 years of public and private sector experience working at the intersection of energy and environment, including having served as the managing director of a commercial energy services company, and as founding Director of Sustainability for the City of Somerville, MA. Peter’s work at Fidelity work focuses on corporate sustainability initiatives targeting carbon emission reductions, energy and water efficiency, waste minimization and renewable energy strategy, as well as programs promoting healthy workplaces and alternative commuting. Peter holds a Master’s degree from the Center for Energy and Environment at Boston University, and a B.A. in Political Science from Middlebury College, and began his career in ocean-going paleoclimatological research at the Woods Hole Oceagraphic Institution.

-

DANIELLE KARAMItem Link

CEFNext

Director, Environmental Sustainability

Danielle leads the development and implementation of Fidelity’s enterprise climate resilience strategy to assess and address climate-related business risks and opportunities. Danielle is also the founder and former Global Co-Chair for the Impact Special Interest Group (SIG), which empowers 5,000+ associates across Fidelity to create positive environmental impact and contribute to corporate sustainability goals. Danielle joined Fidelity in 2019 from the USAID’s Global Climate Change Office in Washington, D.C. where she served as a Senior Climate Change Adaptation Advisor and managed a global portfolio of programs that reduced city, national and regional vulnerability to climate risks across Asia, Latin America, and the Caribbean. Danielle's experience working in the environmental field spans 19 years. Danielle has a Bachelor of Arts in Environmental Studies from Connecticut College and a Master of Environmental Management from the Yale School of Forestry and Environmental Studies. In 2020, Danielle obtained a certificate in Climate Change Policy from the Harvard Kennedy School of Government.

Latest Sustainability Reporting

Highlights

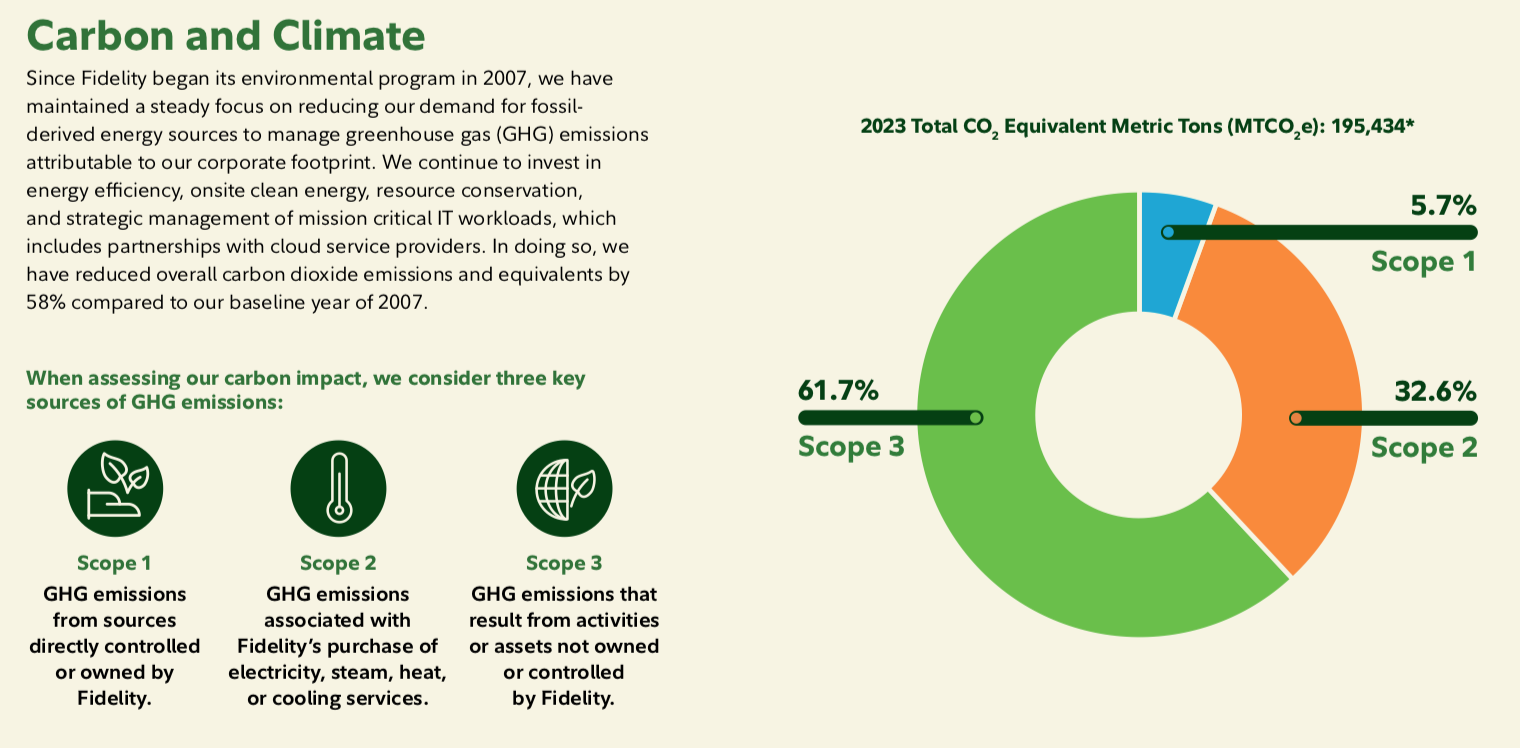

- 58% reduction in overall carbon dioxide emissions and equivalents compared to 2007 baseline

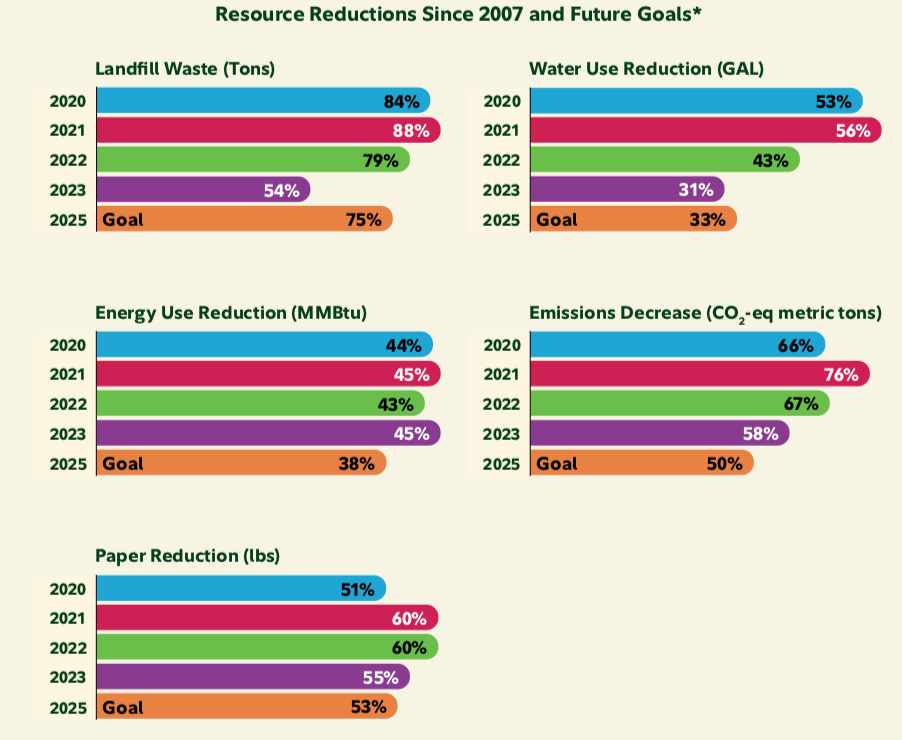

- 45% reduction in energy use compared to 2007

- 55% reduction in paper use compared to 2007

- 54% reduction in landfill waste compared to 2007

- 31% reduction in water use compared to 2007

- 43% increase in the diverse applicant pool compared to 2022

- 84% of associates report that Fidelity creates a culture of inclusion

Recent News

2023

Restoring Ecosystems Through Invasive Species Control (Wildlife Habitat Council (WHC)) — This white paper details key methods corporations can use to control invasive species, a vital part of habitat restoration and conservation projects. These efforts also provide opportunities for corporations to involve and educate surrounding communities, especially as effective invasive species control extends beyond fence lines, requiring strong partnerships with local landowners, conservation organizations, and others. The report includes ten case studies from North America, Spain, and China and includes projects by CEF members Fidelity Investments, General Motors, and WM. (May 2023)

Launched Invest in My Education, a new initiative committing $250 million to provide access to education and support for up to 50,000 Black, Latinx, and historically underserved post-secondary education students. The program will focus on financial wellbeing, bringing together scholarships, mentoring, student success and education expertise, as well as experienced nonprofit partners to improve the long-term outcomes of these students. (Jan 2023)

2021

Climate Action 100+ —

The group of

615 investors managing $60 trillion in assets released a new

report

through IIGCC detailing their expectations for electric utility companies’ net-zero transitions. They called on utilities to target

net-zero emissions by 2035 in developed countries and by 2040 in developing countries, as well as a minimum 50% emission reduction by 2030. They also expect companies to

commit to providing a “just” net-zero transition.

Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments, J.P. Morgan Asset Management

(JPMorgan Chase & Co.’s asset management division), and

TD Asset Management

(of TD Bank Group).

(Oct 2021)

MORE »

Investors engaging Asian firms on climate targets — A new group of investors managing a combined $4 trillion of assets

will engage with Asian banks, power utilities, and other large companies to encourage them to make concrete climate commitments (e.g., ending financing for fossil fuels) and

ensure they have commitment roadmaps. The group is facilitated by Asia Research & Engagement and includes

Fidelity International and

Aviva Investors. (Oct 2021)

MORE »

2021 CDP Science-Based Targets Campaign — A group of

220 global financial institutions across 26 countries holding $29.3 trillion in assets sent a letter to over 1,600 companies urging them to set science-based emission-reduction targets through the SBTi.

Companies targeted by the campaign, which is coordinated by

CDP, have a

market capitalization of over $41 trillion

and

account for 11.9 gigatons of direct emissions—more than the annual GHG emissions of the U.S. and the European Union combined. The

220 signatories include

Allianz, Amundi,

Cathay Financial Holding Co,

Credit Agricole, Fidelity International, Insight Investment Management, Legal & General Investment Management,

Manulife Investment Management.

(Oct 2021)

MORE »

Climate Action 100+

— The group of 617 global investors managing over $55 trillion in assets

released a

set of expectations

laying out necessary actions for the food and beverage sector to achieve net-zero emissions in line with the Paris Agreement goals. Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments, J.P. Morgan Asset Management,

and

Wells Fargo Asset Management.

(Aug 2021)

MORE »

FIDELITY INTERNATIONAL — Committed to

reaching net zero across its operations by 2030.

(Aug 2021)

MORE »

Climate Action 100+

— A group of 545 global investors managing over $52 trillion in assets released a sector strategy with key expectations for steel producers and other steel value chain stakeholders to align with Paris Agreement decarbonization goals. The strategy was published by the Institutional Investors Group on Climate Change (IIGCC). Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments,

and

J.P. Morgan Asset Management.

(Aug 2021)

MORE »

53 global investors managing over $14 trillion of assets released a

statement,

through the

Institutional Investors Group on Climate Change (IIGCC), calling on companies to disclose a net-zero transition plan, identify the director leading the plan, and provide a way for investors to vote on progress against the plan annually.

The 53 investors include

Fidelity International, J.P. Morgan Asset Management,

and

BNP Paribas Asset Management.

(Aug 2021)

MORE »

FIDELITY INTERNATIONAL — Published its

Sustainable Investing Voting Principles and Guidelines,

which state that

starting in 2022, it will vote against company management of companies that don’t meet its minimum expectations around climate change impacts, GHG emissions, climate-related disclosures, and female board representation of at least 30% in the most developed markets and 15% in other markets.

(Aug 2021)

MORE »

Net Zero Asset Managers initiative — The global group of asset managers has

41 new signatories for a total of 128 managing $43 trillion, almost half the global asset management sector. Founded in December 2020 by 6 investor networks, including

Ceres, CDP,

and

Principles for Responsible Investment, signatories include

BlackRock, Fidelity International, and Vanguard.

(July 2021)

MORE »

Driving Net-Zero Emissions Transition in Asian Electric Utilities

—

A new program coordinated by the Asia Investor Group on Climate Change to engage Asian electric utility companies on cutting emissions, strengthening disclosure, and improving governance of climate-related risks. It is

backed by 13 global asset managers collectively managing $8.8 trillion,

including JP Morgan Asset Management

and Fidelity International.

It will complement and run in parallel with the Ceres-led

Climate Action 100+initiative. (June 2021)

MORE »

Net Zero Investor Framework — New effort produced by the Institutional Investors Group on Climate Change (IIGCC) aiming to provide investors with practical approaches to align portfolios and investments to 1.5 °C net-zero strategies. 37 investors managing $8.5 trillion—including Fidelity and PIMCO—have already begun to use the framework. (March 2021)

The Take on Race Coalition, led by Procter & Gamble, announced a new initiative (“One Million Connected Devices Now”) to deliver one million connected devices to students lacking access to digital devices and tools. The Partners include Comcast, Dell Technologies, Dow Jones, Fidelity, Intel, Microsoft Corp, PNC Bank, PolicyLink, and Walmart. Additional partners are welcome. (February 2021)

Over 60 companies committed to the Stakeholder Capitalism Metrics, an ESG reporting and disclosure framework developed by the WEF and its International Business Council that consists of 21 core and 34 expanded metrics. Companies pledging to implement this reporting framework include Bank of America, Dell Technologies, Dow, Ecolab, Fidelity International, HP, Mastercard, McKinsey & Co., Siemens, and Unilever. (January 2021)

A $2 trillion, 85-member investor group led by Fidelity International submitted an open letter to the UN highlighting the “unfolding humanitarian crisis at sea” for marine workers stranded due to border closures and restrictions imposed by Covid-19. (January 2021)

HRH The Prince of Wales announced a “Terra Carta” (Earth Charter) outlining nearly 100 actions for businesses that form the “basis of a recovery plan to 2030 that puts Nature, People, and Planet at the heart of global value creation.” Released by the Prince’s Sustainable Markets Initiative, the Charter was signed by CEOs from AstraZeneca, Bank of America, Blackrock, BP, Fidelity International, HSBC, State Street, Unilever, among others. (January 2021)

2019

Launched a proprietary sustainability ratings system that will give companies in 99 investment subsectors a rating of A to E based on assessments relative to subsector peers. (June 2019)

How can we help? Please reach out to us!

Laura Keenan, Chair

laura@corporateecoforum.com | (617) 921-2307

Amy O’Meara, Executive Director

amy@corporateecoforum.com | (857) 222-8270

Mike Rama, Deputy Director

mike@corporateecoforum.com | (607) 287-9236

Margaret Zamoyta, Program Lead

margaret@corporateecoforum.com I (917) 678-4161

MR Rangaswami, Founder